2023 Power Market Review:

A year of firsts and surprises

January 8th, 2024 CWP Energy Solutions

As I come to the end of my 15th year in the power markets, it never ceases to amaze me how much and how quickly things can change in an industry that rarely receives plaudits for moving quickly. As we come to the end of the year, I thought it was apt to share some of the greatest surprises we saw here at CWP Energy Solutions both north and south of the border.

Changes in ERCOT – Summer strength and shifts in basis

Having successfully navigated through the Winter, the market took a breather in the Spring, shrugging off any thought of capacity shortages in the Summer as July HB North RT traded down to $62.50 by June 2nd. The emergence of a sustained “heat dome” over Texas caught the market by surprise with forward markets struggling to price ERCOT’s ability to handle such consistently high net loads. Trading for August HB North Peak hit a high of $183 by mid-July, still $100 shy of where it would ultimately settle (DA was ~$100 higher still). Ultimately, August saw ~28% of all peak hours clear above $100 and 14% above $500.

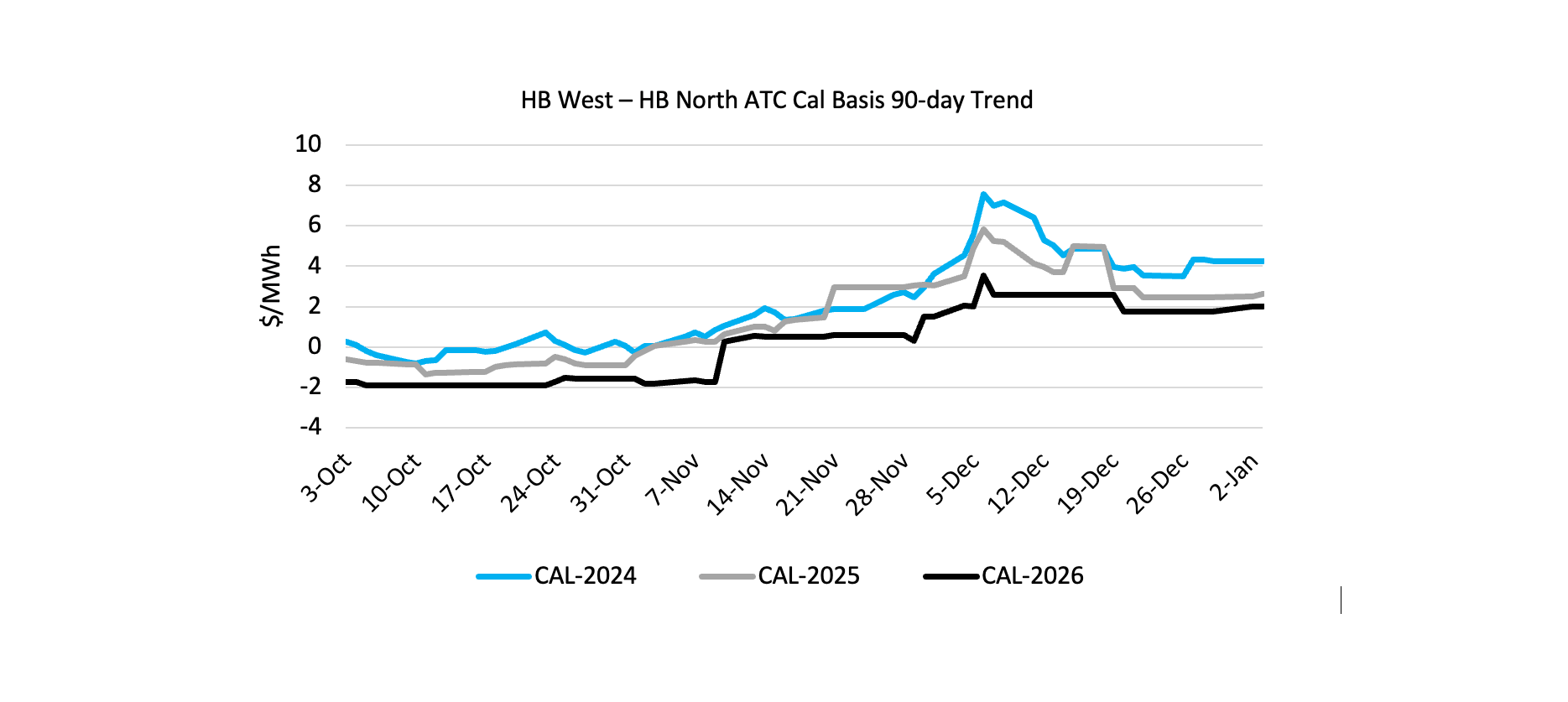

However, the Summer heat dome was not the biggest surprise in ERCOT this year, as congestion and basis patterns within ERCOT really caught the eye. West Texas, which had often been considered a region of strong renewable penetration, lower load and stable/cheap pricing has begun experiencing significant upside price volatility and congestion. So much so, it clearly has the market rattled as HB West is now trading at a premium to HB North across the cals.

Canada an import market? Changing dynamics in Ontario and Quebec

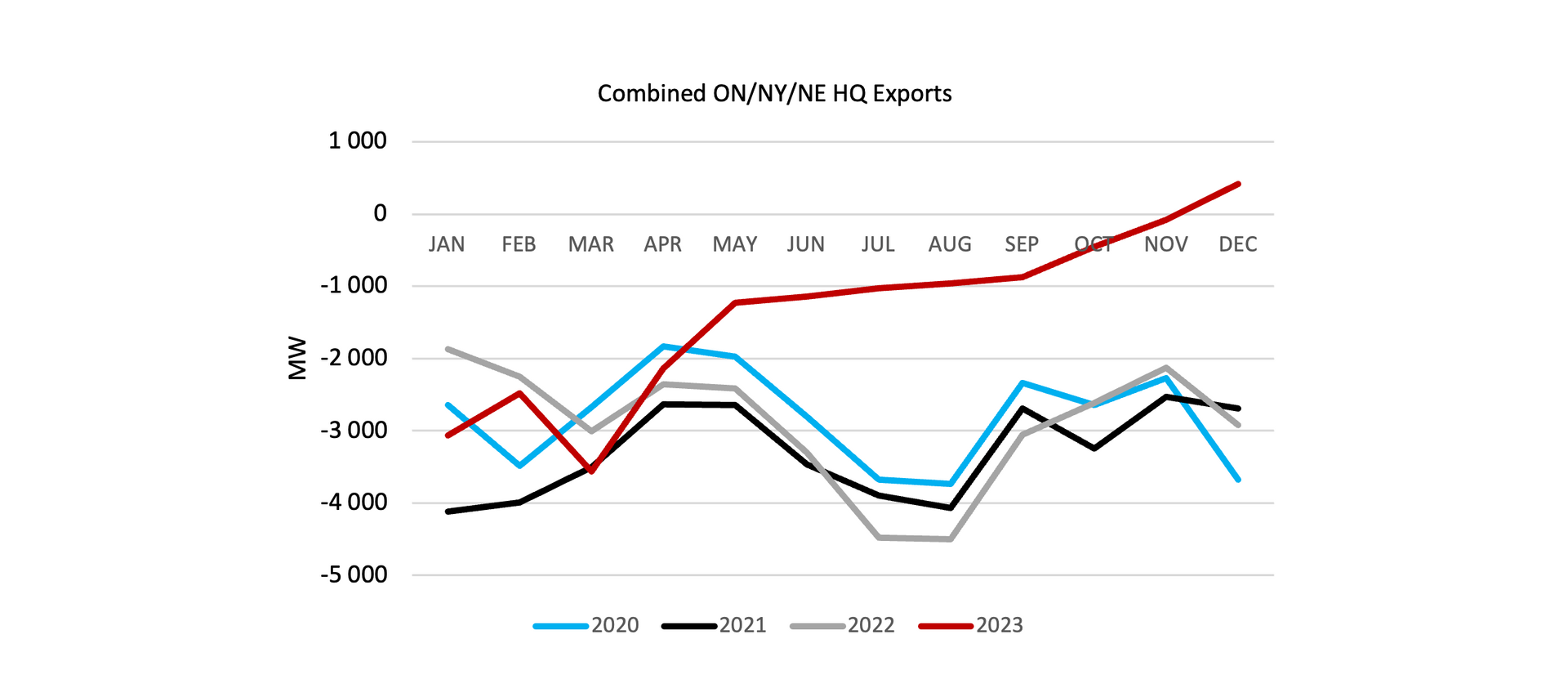

Despite our HQ in Montreal, the role and impact of Hydro-Quebec remains difficult to decipher unless you are paying close attention. As early as June, we began to notice a distinct change in the behaviour of Hydro-Quebec which began ratcheting down exports to its neighbouring jurisdictions at a surprising pace.

I have always viewed Quebec as the “battery of the northeast” but the chart above is telling of the changing role of the Province and also highlights the context behind reports of Hydro-Quebec evaluating the restart of its Gentilly-2 nuclear reactor. A May study by the Montreal Economic Institute forecasted a power shortage of 100 terawatt-hours as early as 2027. Those expecting clean, Canadian imports to save the day to ease the energy transition may be in for a surprise as Quebec battles to serve its own local demand.

Ontario was also not without firsts. The Province continues to navigate through the refurbishment of its nuclear fleet at Bruce Power and Darlington and the ongoing lack of baseload generation has posed its own unique challenges to the IESO. In sticking with our theme, Ontario saw import congestion from MISO in two months in 2023, something that hasn’t been seen since the infamous winters of 2013/14.

Natural Gas

Coming out of the other side of the energy crisis and Winter Storm Elliott, 2023 began with talk of “a new normal” with natural gas expected to find a new equilibrium at price levels at a significant premium above the historic glut that had been seen in more recent times. Winter 2024 premiums were robust and focus was heavily on record power burns, record exports and a market struggling to forecast storage injections (more so than normal).

Not to be outdone by the demand side, supply has been setting records too, mirroring the consistent growth seen in domestic oil production since the pandemic. Current weekly production averages are also at record levels, hovering around 106 Bcf/d.

With the first look at Winter cold now around the corner, declining rig counts and a market which is currently bias short, the second half of 2024 looks interesting, to see if the market can shake off the projected overhang of +1,900 Bcf End of Season storage projections.

(Candlestick Chart of February 2024, Henry Hub and volumes. Source: ICE)

The energy landscape continues to evolve with changing volatility patterns, shifting basis and new market dynamics that require sound risk management. At CWP Energy Solutions, we remain on the cutting edge of these transitions and can act either as an out-of-the-box trading arm or a natural extension of your pre-existing team. If you have questions on how our active asset management could benefit your strategic goals, please contact me at matthew@cwpenergy.com