BESS Leads The Way

March 4th, 2024 CWP Energy Solutions

The CWP Energy Solutions team recently had the pleasure of attending this year’s ERCOT Summit in Austin, TX. It was a very exciting event as we were able to learn about new developments in the ISO and what the future looks like in ERCOT, all while meeting old and new fellow market participants.

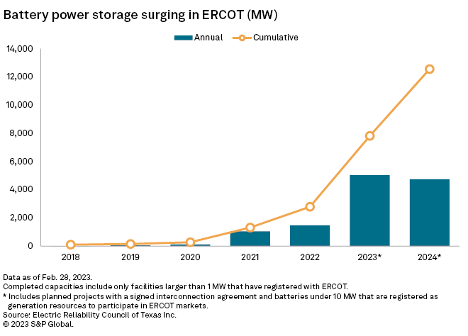

Battery Storage Capacity - On The Rise

While last year’s ERCOT Summit had a distinct flavor and theme, focusing primarily on the new Performance Credit Mechanism (PCM), this year the talk was all about energy storage, i.e. batteries. Battery Energy Storage System (BESS) has grown exponentially in the last few years and will only continue as the ERCOT market continues to evolve and expand, requiring additional dispatchable resource capacity for high demand days and maximizing volatile intermittent renewable generation.

Market Saturation

According to the Generator Interconnection Status (GIS) Report[1] released by ERCOT on February 1st, 2024, there are over 9 GW of batteries currently in the ERCOT queue that have completed the Full Interconnection Study and Interconnection Agreement. While we can assume not all of this storage capacity will come online, revenue contributions from the Ancillary Reserve market will naturally decline going forward as more participants competitively offer into the market. This underscores the opportunity for asset owners to generate revenue via energy arbitrage, i.e. charging and discharging batteries in the intraday energy market for a profit.

[1] https://www.ercot.com/mp/data-products/data-product-details?id=PG7-200-ER

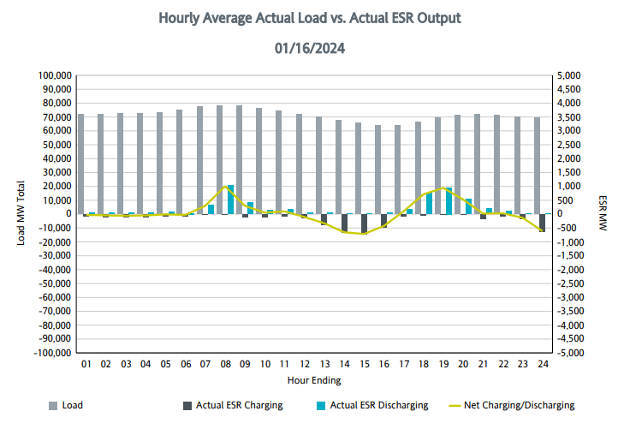

Winter Storm Heather

The increasing reliance on intermittent renewable generation has created increased challenges for ERCOT to maintain grid reliability, particularly as photovoltaic (PV) capacity has become a more significant tranche of the generation stack. Batteries can provide the solution in helping to stabilize the grid when solar ramps off in the evening and demand is still high, resulting in market volatility and higher prices.

Energy storage provided much needed assistance during Winter Storm Heather, the latest extreme weather event to hit ERCOT. Frigid temperatures, which hit ERCOT hardest on January 16th, provided such an opportunity for energy arbitrage. Battery owners[1] were able to charge their assets between HE13-16, and discharge between HE17-21 (see chart below), when the net load was peaking. While not an exact price approximation due to specific grid location of respective storage assets, Hub North LMP prices averaged approx. $34/MWh between HE13-16, and 5-minute LMPs priced as high as $1214 between HE18-20[2] with an average of $474/MWh.

[1] https://www.ercot.com/mp/data-products/data-product-details?id=NP4-765-ER

[2] YesEnergy.com ERCOT Price Map RT Price

CWP Energy Solutions

With over a decade of expertise in power trading, our firm stands at the forefront of the industry. At the heart of our success lies our robust Quant Models, powered by Machine Learning and Artificial Intelligence. These sophisticated tools empower us to navigate the complexities of the energy market with precision and agility.

One of our crowning achievements is the development of our DART optimization expertise, seamlessly integrated into our algorithms for battery trading and arbitrage. This world-class capability enables us to unlock unparalleled value for our partners, leveraging real-time data to seize opportunities and mitigate risks effectively. Our models are designed to optimize around ancillary services, Day-Ahead, and Real-Time trading scenarios. We stay ahead of the curve by forecasting weather patterns and meticulously analyzing constraints and congestion patterns on the ERCOT electric grid.

Reach out to explore tailored strategies for optimizing your energy BESS portfolio. If you have any questions on how our active management could benefit your strategic goals, please contact me at tony.vendittelli@cwpenergy.com