November 29, 2022 | Alain Brisebois

After years of permitting, supply chain delays and financing, you finally close on the project that has kept you and the development team occupied for the better part of a year. The project is passed to your asset management division and you move onto trying to dissecting the implications of the IRA with legal and hopefully live a happy life.

Fast forward a year and you’re pulled into an emergency meeting with the asset management team, tax equity, the offtaker, and an army of lawyers. That project that kept you up at night is once again interrupting your REM cycle. [Cue Apple watch stress alerts]

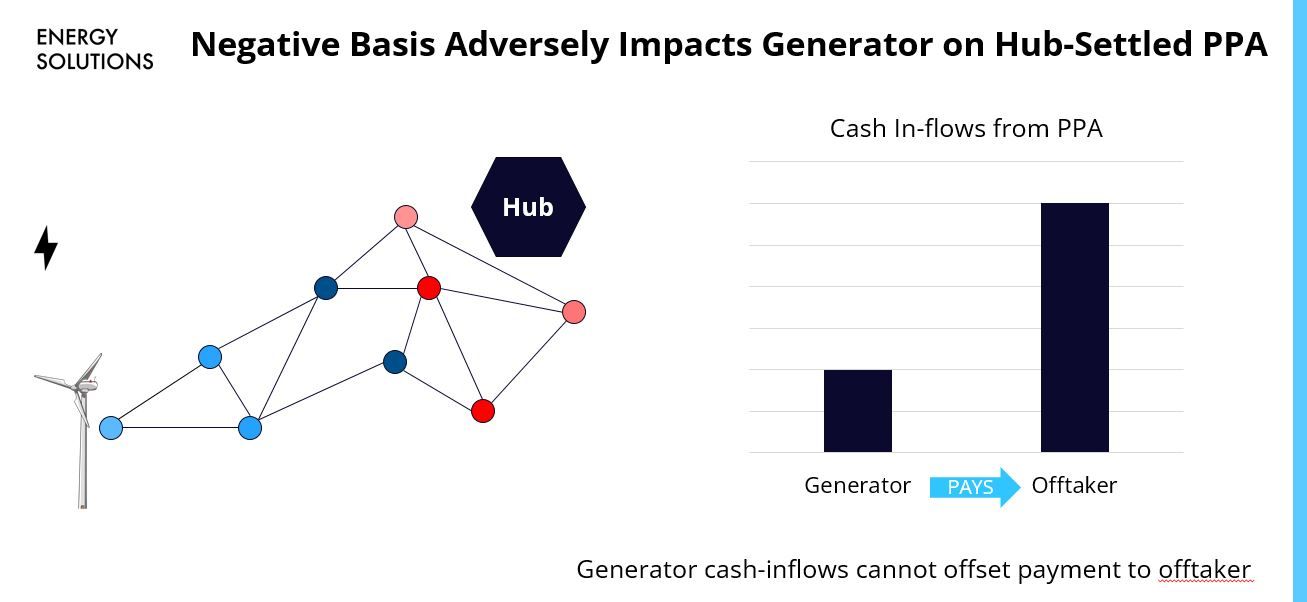

Offtake arrangements can fall apart for a multitude of reasons, but more often we see relationships degrade when the allocation of risks inherent in PPAs are too lopsided in favor of one party or another. In many cases this manifests in the form of basis: when prices at the resource node are substantially dislocated from the liquid hub.

We often think of basis as a problem for the asset owner/manager – when hub-settled prices are higher than nodal prices, the asset revenues are insufficient to pay down the cash outflows to the offtaker when the settlement price goes above the strike.

But basis is inherent in busbar PPAs for the offtaker too – if the offtaker wants to de-risk their portfolio (i.e. sell some of their position), they typically need to do so at the nearest liquid hub, or face trying to sell the busbar exposure at a hefty discount to what they originally purchased it for.

As counterparties become more sophisticated in understanding the risks inherent in offtake arrangements, the question of how to deal with basis becomes of increasing importance. How do we share in the risk to ensure that this ten-year PPA isn’t a two-year contract ending in default?

As experts in congestion management and asset optimization, we can help.

At CWP Energy Solutions we know that there is no silver bullet to resolving basis risk. That’s why we believe in using the whole suite of tools available to de-risk portfolios and improve returns.

If you have a project that keeps you up at night, ask about what CWP Energy Solutions may be able to do for you!.