Will hydro "flood" power markets in CAISO?

May 9, 2023 | CWP Energy Solutions

Throughout the past decade, the Western United States has experienced extremes in water supply spanning multiple years, with the most recent drought starting in 2020. The US-portion of the Western Interconnect, spanning across the West Coast and east through the Rocky Mountains, relies on hydroelectric generation as a primary source of low-cost electricity and is highly impacted by water supply as a result.

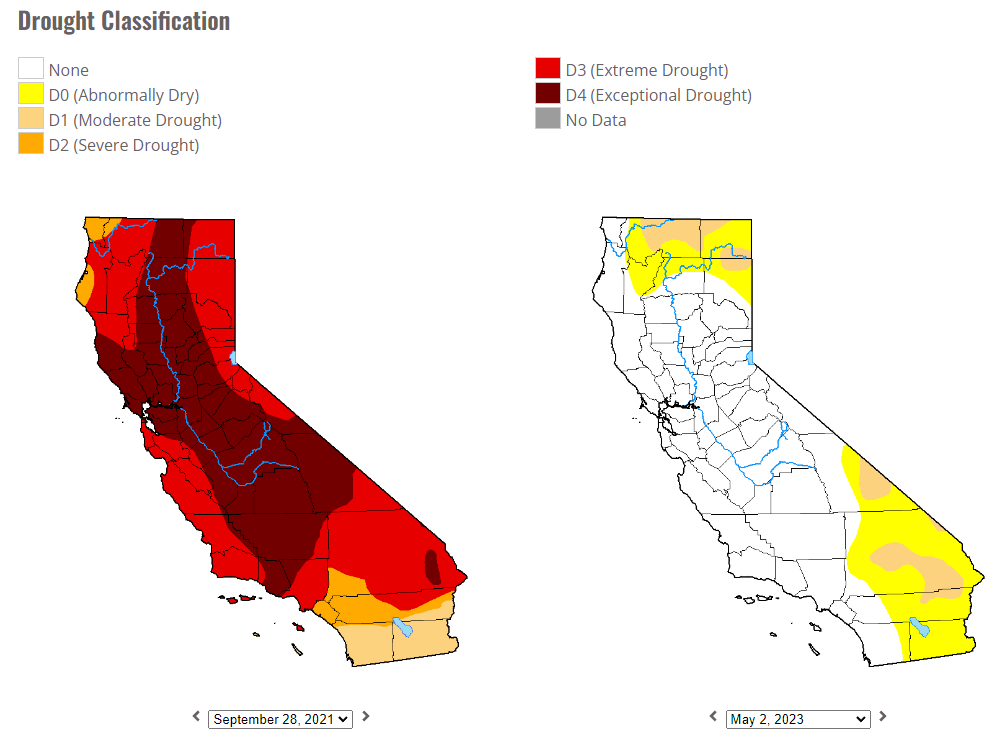

Source: U.S. Drought Monitor, National Drought Mitigation Center, University of Nebraska-Lincoln

While a lack of precipitation can create challenges, so too can excessive water supply. By the end of September 2021, much of the Western United States was experiencing drought. California was exceptionally dry, with 95% of the State classified at-or-above “Severe Drought” status. However, a continued La Niña prompted a sudden reversal in precipitation in 2022, as California was bombarded by an atmospheric river, bringing about record snowpack and rapidly re-filling previously depleted reservoirs.

Entering 2023, California ISO is now faced with a new problem: managing excess hydroelectric generation.

In CAISO, hydro can constitute as much of 20% of power supply, with imports from the Pacific Northwest also a function of hydroelectric availability. The sale of hydroelectricity is a complex optimization, that often requires an understanding of long-term opportunity cost constrained by expectations for future reservoir levels as well as the ability to meet water supply contracts.

With a large snowpack melt looming, operators are now tasked with optimizing energy production over a shorter tenure, as solar production in CAISO regularly pushes mid-day power pricing exceptionally low. When targeting to sell into the highest-priced hours of the day, hydro competes directly with CAISO battery storage. Hydroelectric generation is not only capable of selling energy, but is also capable of selling ancillary services, creating prospective cannibalization of revenues targeted by most battery storage projects in CAISO.

In stark contrast to years past, CAISO now enters summer with what is likely to look like over-supply on most days, with a substantial amount of capacity available to manage the steep evening ramp in net load. We anticipate this is likely to push energy prices lower on average, and severely limit earnings potential in Day Ahead for storage resources, with Day Ahead Energy Arbitrage and Ancillary Service earnings potential eroded by substantial sales of hydroelectric capacity in Day Ahead markets.

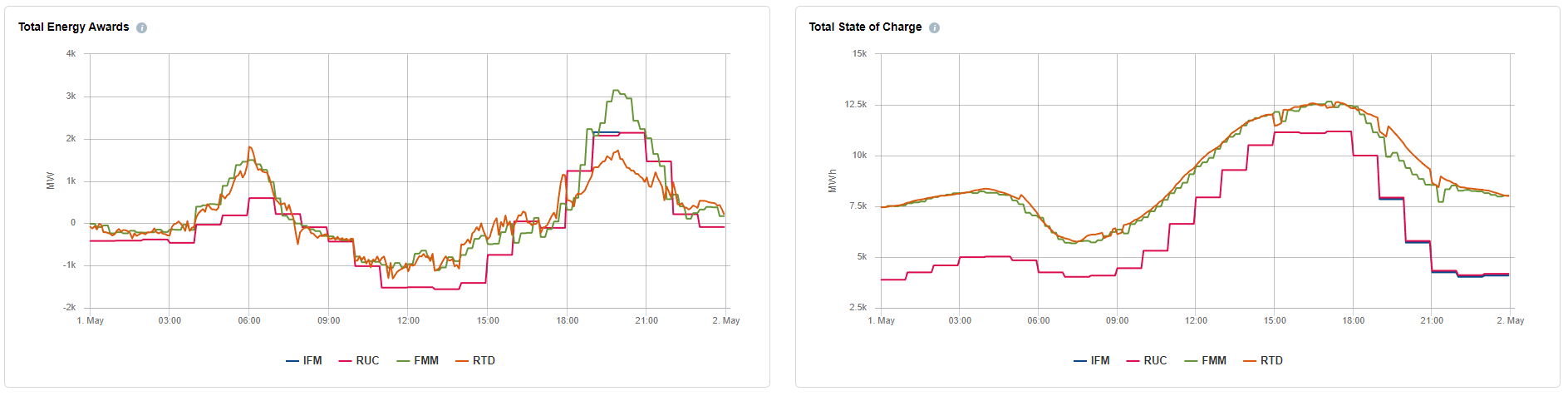

With that in mind, the commitment of storage resources in Day Ahead creates incremental opportunity in Real Time. As CAISO’s daily reports show, market participants are already looking to deviate from their day-ahead schedules in pursuit of incremental revenues.

May 1, 2023 CAISO System Battery Storage Aggregated Awards

Source: CAISO Daily Energy Storage Report

Unsuspecting changes in supply or demand intra-day become more difficult to manage with storage resources running strictly to a Day Ahead schedule. Battery storage, when confined by a state of charge, can further exacerbate supply scarcity, while hydroelectric generation may be confined by operational parameters unrelated to power markets. As a result, we see incremental value in Real Time optimization and identifying periods of Real Time risk that emerge from having a wealth of storage supply serving load.

With hydroelectric generation weighing on the earnings potential of battery storage this summer, the ability to manage your resource in Real Time is paramount to managing risk and maximizing storage revenues in the handful of hours with opportunity. If you operate a storage resource and would like to learn more about unlocking the incremental value in Real Time optimization, make sure you reach out!