Does California solar show us a glimpse of the horizon?

August 18, 2023 | CWP Energy Solutions

It’s no secret – a massive amount of solar capacity has come online within the continental US across the last decade. The majority of this capacity has been in the Southwest and in particular, California, where solar irradiance lends to the highest prospective generation. Since 2010, California has added more than 16 GW of solar photovoltaic (PV) utility-scale nameplate capacity. On a typical summer day in California, solar can easily constitute 50% of total supply during the peak load hour and as much as 75% during peak solar supply mid-day.

Source: NREL

The copious solar capacity in California has created several new market dynamics, perhaps most notoriously the infamous “duck curve” – the period during which solar generation, both behind-the-meter and utility scale, floods the market and decreases pricing by simultaneously lowering demand and displacing marginal fossil-fired generation. In 2023, CAISO has started to feel that period of oversupply in a more remarkable way, with SP-15 real-time pricing in HE 11 – 15 across April and May averaging below zero. But the “duck curve” does not just create price weakness mid-day; it also creates a challenge for the grid operator in the evening, when rapidly declining solar generation must be displaced with fossil-fired generation in a short amount of time, often lending to price volatility and real-time price strength in late evening hours.

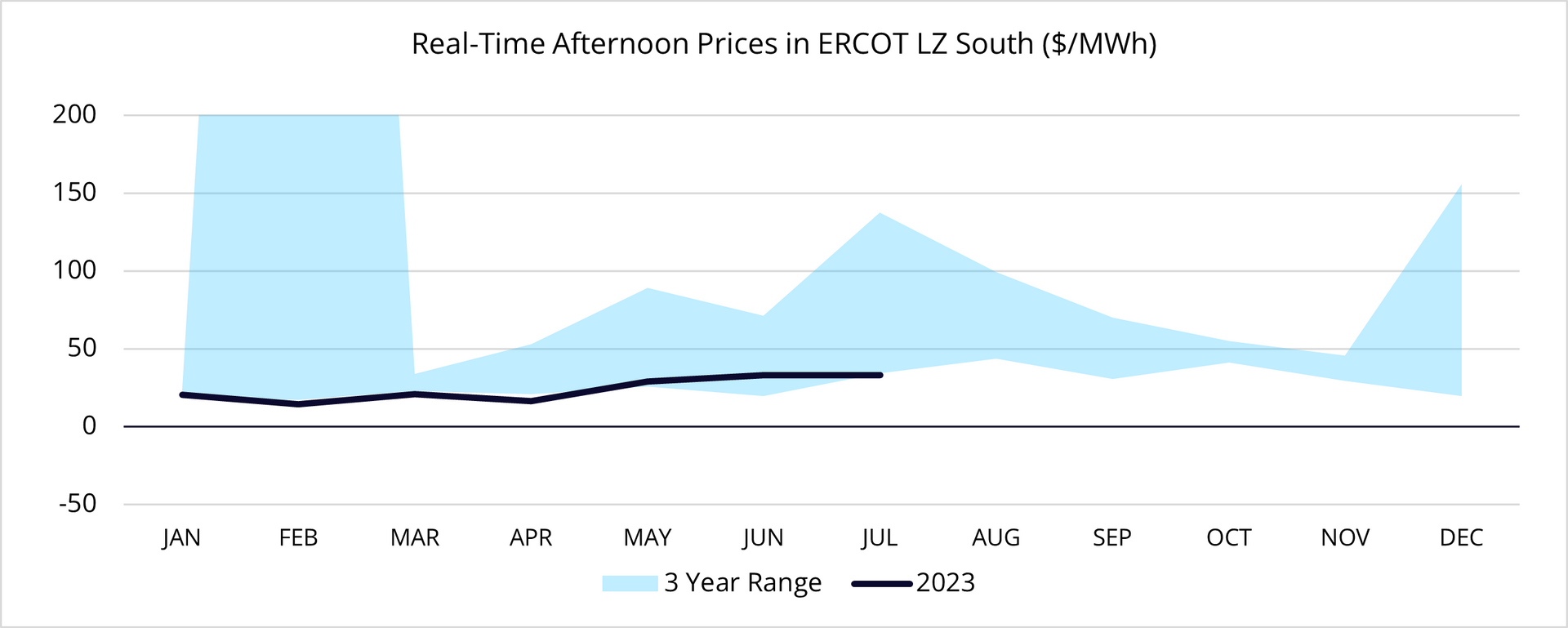

Note: "Afternoon" refers to HE 11 - 15

As the Southwest US has become more saturated with solar resources, we have seen massive growth in solar in ERCOT, with similarly advantageous irradiance and an abundance of lower-cost land. With over 25 gigawatts of solar capacity still anticipated to come online in ERCOT in the coming years, the “duck curve” emergence in Texas is not as far off as one may believe. In 2023 year-to-date, we’ve begun to see the weakening of real-time pricing mid-day accompanied by regular price volatility coinciding the late evening hours in which solar comes offline.

As in the case of California, the hours after sunset will see more market tightness and demand for replacement supply. ERCOT price volatility has become increasingly driven by wind performance – if wind is increasing during the late evening hours, pricing tends to be weaker, whereas if wind is decreasing or under-performing forecast, the real-time price volatility in the late evening has become more extreme. The dominance of solar will indirectly contribute to price volatility.

The late evening “solar ramp” is also impacted by ERCOT’s 4CP program, in which loads look to curtail load during the peak hours of the day to avoid an incremental billing line item. We have frequently seen loads come back online after the peak load hours, increasing demand while solar generation is rapidly declining, further exacerbating supply scarcity.

Note: "Afternoon" refers to HE 11 - 15

The extreme volatility – both price weakness and strength – poses challenges to market participants of all kinds. In particular, the inverse relationship between solar generation and pricing that continues to emerge in ERCOT poses substantial risks to the economics of both existing and new solar assets. Price weakness and congestion mid-day poses basis and curtailment risk, while price strength in the late evening can pose volumetric risk for assets with fixed-shaped hedges. With the full array of financial instruments available in ERCOT, a strategy can be tailored to meet any specific set of risk parameters (such as basis, volumetric, credit) to mitigate the growing risks presented by the saturation of solar.

At CWP Energy Solutions, we approach market risks head-on alongside our clients. Using our in-depth market knowledge and trading experience, we work with asset operators to optimize value while managing risks. Be sure to contact us to find out what a partnership can look like for you! If California provides any foresight into the future, markets can change drastically in short order and any delay may jeopardize profits!