ERCOT's price volatility is not the problem, it's the solution!

September 25, 2023 | CWP Energy Solutions

In response to Winter Storm Uri in February 2021, Senate Bill (SB) 3 was passed to study ways to strengthen and weatherize the electric grid. The resulting proposal – the Performance Credit Mechanism (PCM) – emerged from a long and contentious stakeholder process. Similar to pay-for-performance mechanisms in the Northeast power markets, the PCM is design to incentivize generators that perform during periods of supply scarcity, while penalizing generators that fail to perform or generate little during periods of tightness.

The other challenge in deploying the PCM is timing. Realistically, the PCM is unlikely to take effect until 2027, providing little relief to ERCOT’s capacity-starved market in the interim. Thus, in January 2023, the Public Utility Commission of Texas (PUCT) ordered ERCOT to evaluate bridging options to retain existing generation and build new dispatchable generation until the PCM can be fully implemented.

Passed in July 2023, House Bill (HB) 1500 provided more specific criteria on generator reliability requirements, cost allocation, and cost caps to the PCM. In addition, HB 1500 shed light on the PCM bridging option, that involves modifying the existing Operating Reserve Demand Curve (ORDC). The Bill ordered the bridging option to be in place within four months of approval (Jan 2024) and would be adjusted/in-place until PCM deployment, targeted in 2027.

To better understand the bridging option, it is important to first understand the ORDC’s purpose. Without a formal capacity market, ERCOT relies on price signals in an energy-only wholesale market to incentivize new generation development and to provide a financial signal for operating resources.

In other words, extreme wholesale energy price volatility in ERCOT is a purposeful market design feature, not a problem!

ORDC Executive Summary (for the Speed Readers)

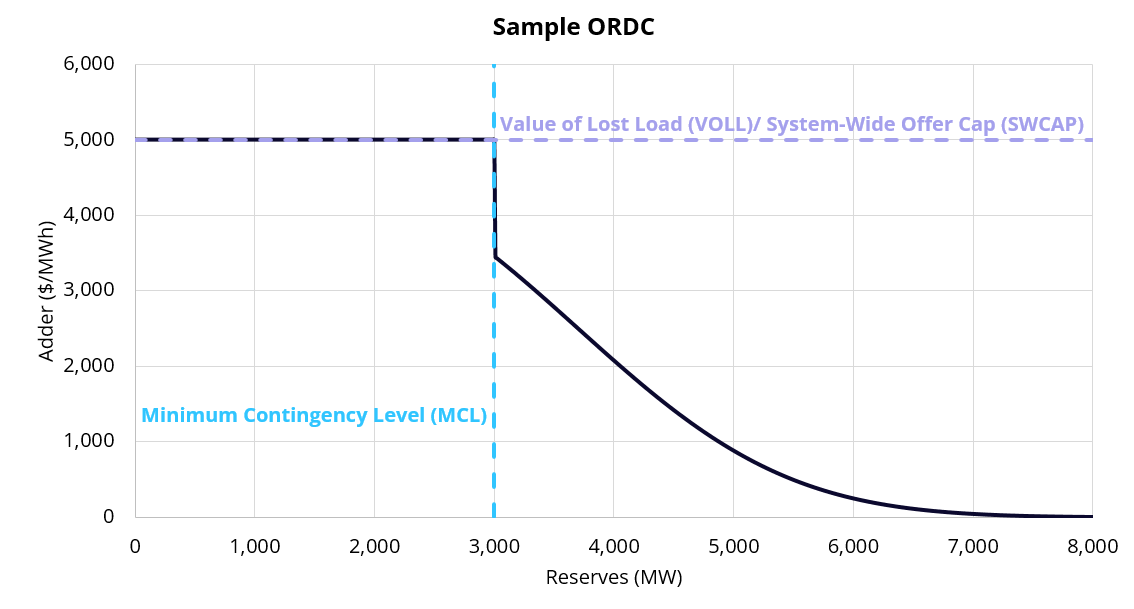

When system demand begins to approach total supply, ERCOT adds a premium to LMP in order to incentivize incremental supply to come online (or for load to turn off). The closer total demand is to total supply, the higher the adder. Settlement prices (LMP + ORDC) are capped at $5,000/MWh, so in some cases the inverse relationship between the ORDC adder and total reserves can break down because LMP is already high.

Technical Session (for the Acronym-Enthused)

Put in place in 2015, the ORDC calculates a set of unique scarcity adders to real-time LMP as a function of available reserves:

RTORPA (Real-Time On-Line Reserve Price Adder); and,

RTOFFPA (Real-Time Off-Line Reserve Price Adder)

These are added onto the system energy component of the real-time LMP, referred to as the System Lambda. There is a third adder, the Real-Time On-Line Reliability Deployment Adder (RTORDPA), that is determined as a function of Reliability Unit Commitment (RUC) and Emergency Responsive Service (ERS) deployment.

Real-time pricing in ERCOT, referred to as the Real-Time Settlement Point Price (SPP), is the sum of LMP, RTORPA, and RTORDPA. These adders are in place to help prevent the operating reserve margin from falling below a pre-determined level, referred to as the Minimum Contingency Level (MCL).

The ORDC is derived by ERCOT based on studies of the Value of Lost Load (VOLL), which quantifies the cost of depleted reserves and load shedding and sets the System-Wide Offer Cap (SWCAP). The ORDC is designed to set adders to VOLL when reserves fall below the minimum contingency level (MCL).

For each five-minute security-constrained economic dispatch (SCED) interval, ERCOT first determines the system lambda, which is then used as an input to determine RTOFFPA, and finally RTORPA. Note that RTORPA itself is a function of RTOFFPA.

RTORPA = max(0, VOLL – λ) x [(0.5 x ORDC(RTOLCAP)) + (0.5 x ORDC(RTOLCAP + RTOFFCAP))]

Why the “bridge”?

In January 2023, the PUCT ordered ERCOT to evaluate “bridging options” with the intention of retaining existing assets and building new dispatchable generation until the PCM is fully implemented.

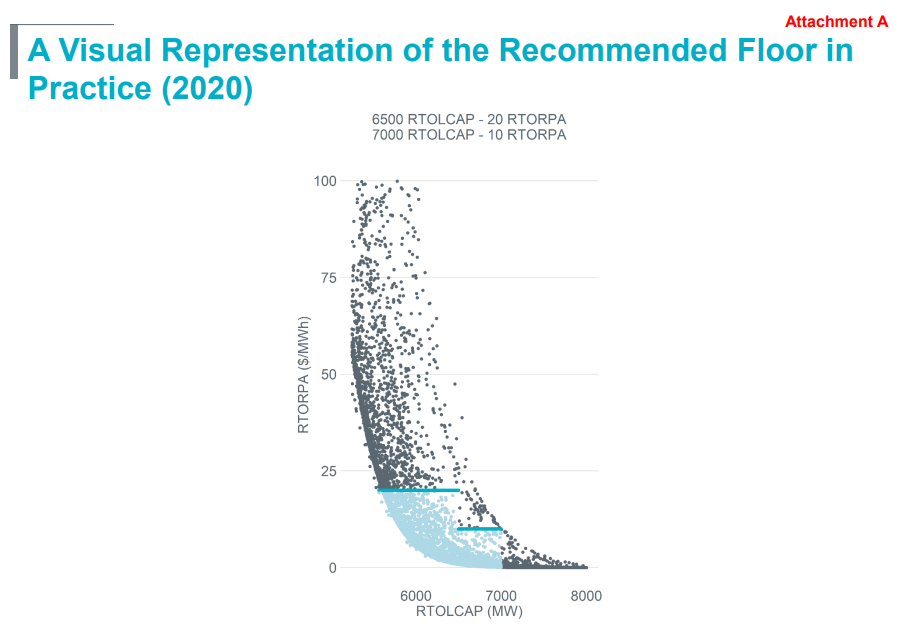

With the PCM anticipated to be years away from implementation, the ORDC “bridge” is designed to be a relatively straight-forward and quick-to-implement solution. The “bridge” – which would essentially be a change to how the ORDC is calculated - applies price floors to the ORDC price such that at higher levels of reserves, a minimum RTORPA/RTOFFPA is achieved.

The general goal is to produce incremental price signals well in advance of periods of lower reserves to encourage an earlier response from supply. According to

analysis published by ERCOT, the incentive would have provided benefit in 2020 and 2022 when Physical Responsive Capability (PRC), another ERCOT measure of scarcity, is low and additional reliability actions may become necessary.

What's going on with adders now?

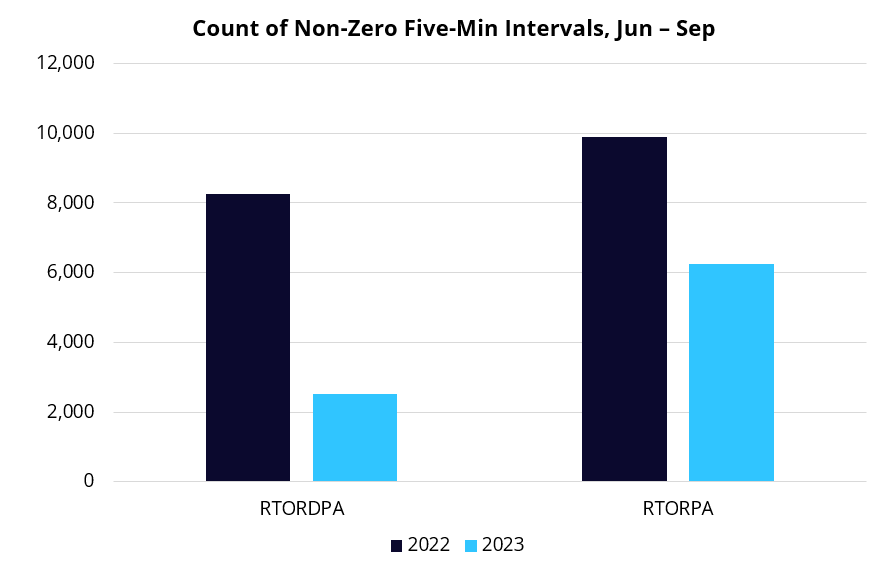

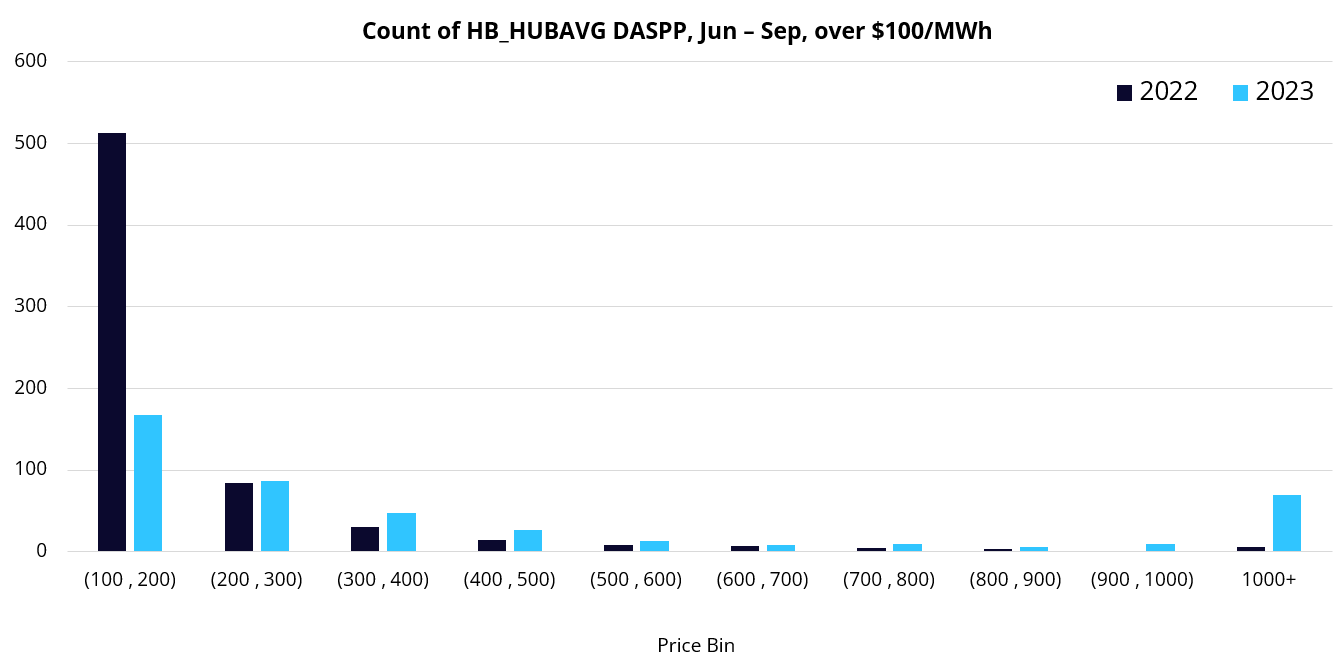

The proposed ORDC revision comes at a time when scarcity adders were substantially reduced year-on-year.

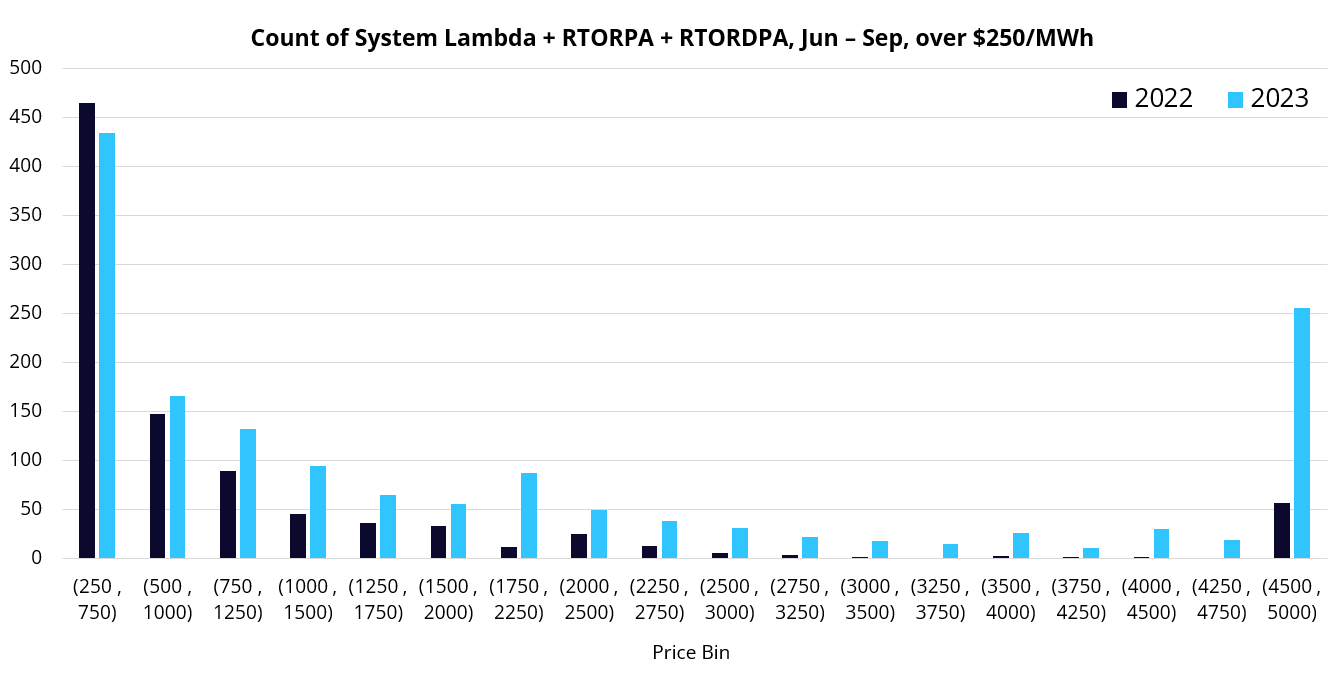

Both reliability deployment adders and online-reserve adders saw a large drop in 2023 relative to 2022, though volatility in Summer 2023 certainly wasn’t limited. In looking at a distribution of system lambda plus adders summer-on-summer, Summer 2023 actually sees an outward shift (increase in price volatility), despite the drop in gas prices summer-on-summer (95% of five-minute intervals in Summer 2023 were under $250/MWh vs 97% in Summer 2022). In focusing on that tail-risk (system lambda + adders > $250/MWh), it is clear that price volatility has increased, despite adders decreasing.

So, what is happening? While more answers will become clear when ERCOT’s unit-specific bid and offer data become available for this summer, one plausible thesis is that generators are beginning to price more scarcity into resource offers. Recall that while ORDC adders are included in Real-Time price, Day-Ahead price does not include adders and instead reflects scarcity with the market’s consensus in Day-Ahead settlement, with price being set by the intersection of Day-Ahead Bids and Offers.

Another added layer of complexity is Real-Time Co-Optimization (RTC) – expected to be implemented by ERCOT now in 2026 – which will show price in real-time to reflect the marginal opportunity cost of providing 1 MW of Ancillary Service in exchange for 1 MW of Energy. The RTC deployment will allow for improved alignment in price signals across all pricing mechanisms (Ancillary Services will be priced in accordance to the overall system reserves on the ORDC), but will certainly further obfuscate the source of price volatility in ERCOT.

Back to the “bridge” – what does it mean for pricing up to 2026?

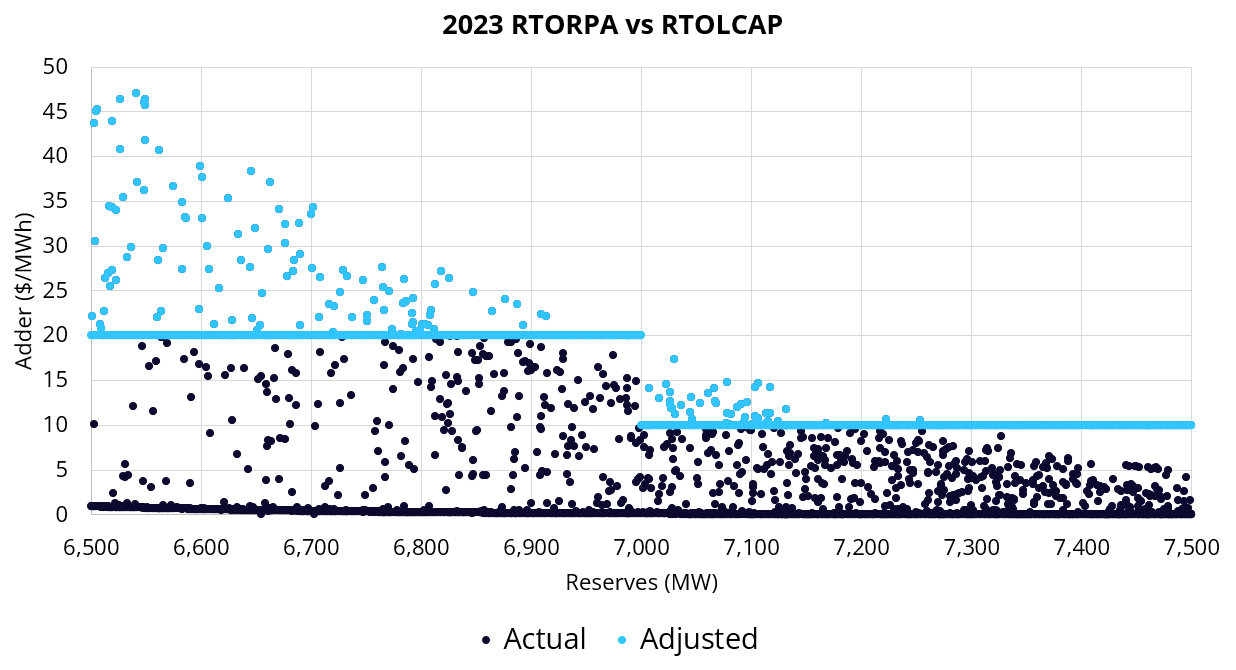

The current bridge proposal imposes a $10/MWh price floor for RTOLCAP between 7,000 and 7,500 MW and a $20/MWh price floor for RTOLCAP between 6,500 and 7,000 MW. The floor is only applied to RTORPA.

ERCOT claims the total increase in resource revenues in both 2020 and 2022 would be around $500 MM (which, assuming resource revenues incorporate all energy generated across each year) equates to about $1.31/MWh in 2020 and $1.15/MWh in 2022, respectively.

In looking at the application of the proposed ORDC price floors to historical RTORPA, we looked to quantify the impact in 2023 YTD.

While the reform certainly adds upside to what is otherwise relatively weak RTORPA (especially for 7 GW+ of RTOLCAP), the overall estimated price impact was limited (under $1/MWh). With this in mind, the question remains – will the ORDC “bridge” be able to satisfy the requirements of Texas lawmakers?

Where will the “bridge” take us?

While the outright price impacts are uncertain (and likely somewhat inconsequential), our analysis did raise an interesting observation: market players are getting more sophisticated. The apparent attempt to price scarcity into resource offers created incremental price volatility and allowed ERCOT to use fewer scarcity adders to prompt the dispatch of incremental supply. However, it also created continued volatility in Day-Ahead / Real-Time spreads and other trading opportunities that could have made – or ruined – a fiscal year.

As ERCOT continues to change and evolve – both from the perspective of market design and fundamentals alike – the need for market knowledge (and how to manage the resulting risk) is paramount to managing a resource portfolio. Regardless of whether you have an existing portfolio or are developing your first asset, be sure to prepare for the risks of tomorrow, not just today.