Does asset-backed trading increase risk? The Trading Fallacy, explained.

October 23, 2023 CWP Energy Solutions

As a tax-equity investor or project owner, you might have considered utilizing asset-backed trading to protect your PTCs and stabilize revenues. But does trading around your asset add risk? The portfolios that we manage serve to highlight why the assumption that trading around an asset always adds risk, is indeed a fallacy.

Asset-backed trading should be viewed as a hedge, just like a PPA or forward sale of energy, and when conducted properly, is sufficiently inversely correlated to project performance. As a result, project returns can increase without increasing total project risk.

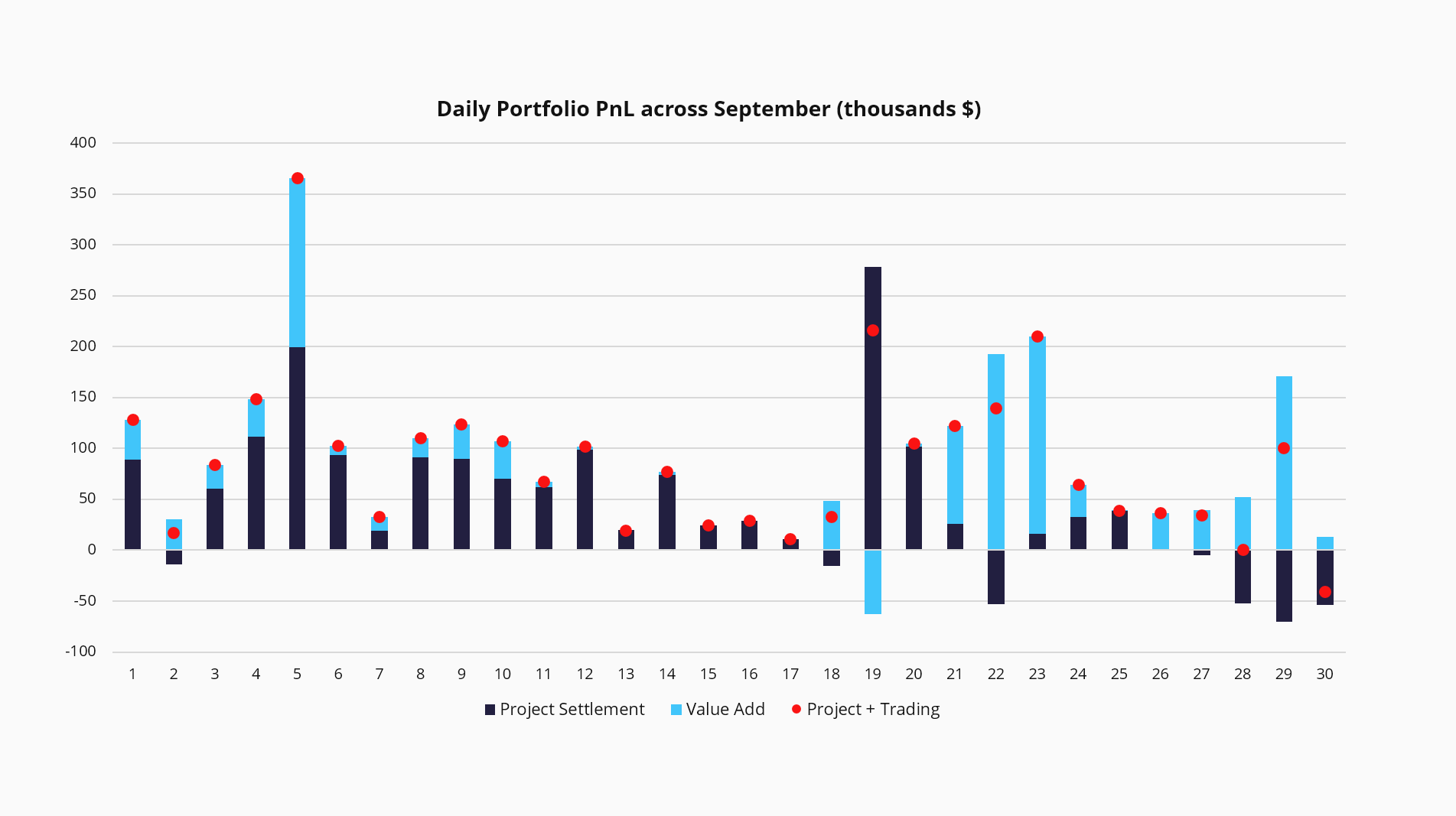

This year has served as a good example of this relationship across the portfolios we manage across SPP.

In June 2023, generation-weighted basis was in the vicinity of $5-7/MWh for portfolios we manage in SPP, as such we were able to add $1-3/MWh while reducing tail-end risk by 10-20%.

Likewise in September 2023, with abnormal heat and high wind coinciding with outages, generation-weighted basis was in the range of $15-20/MWh, during which time we were able to add $5-8/MWh and reduce tail-end risk in excess of 50%.

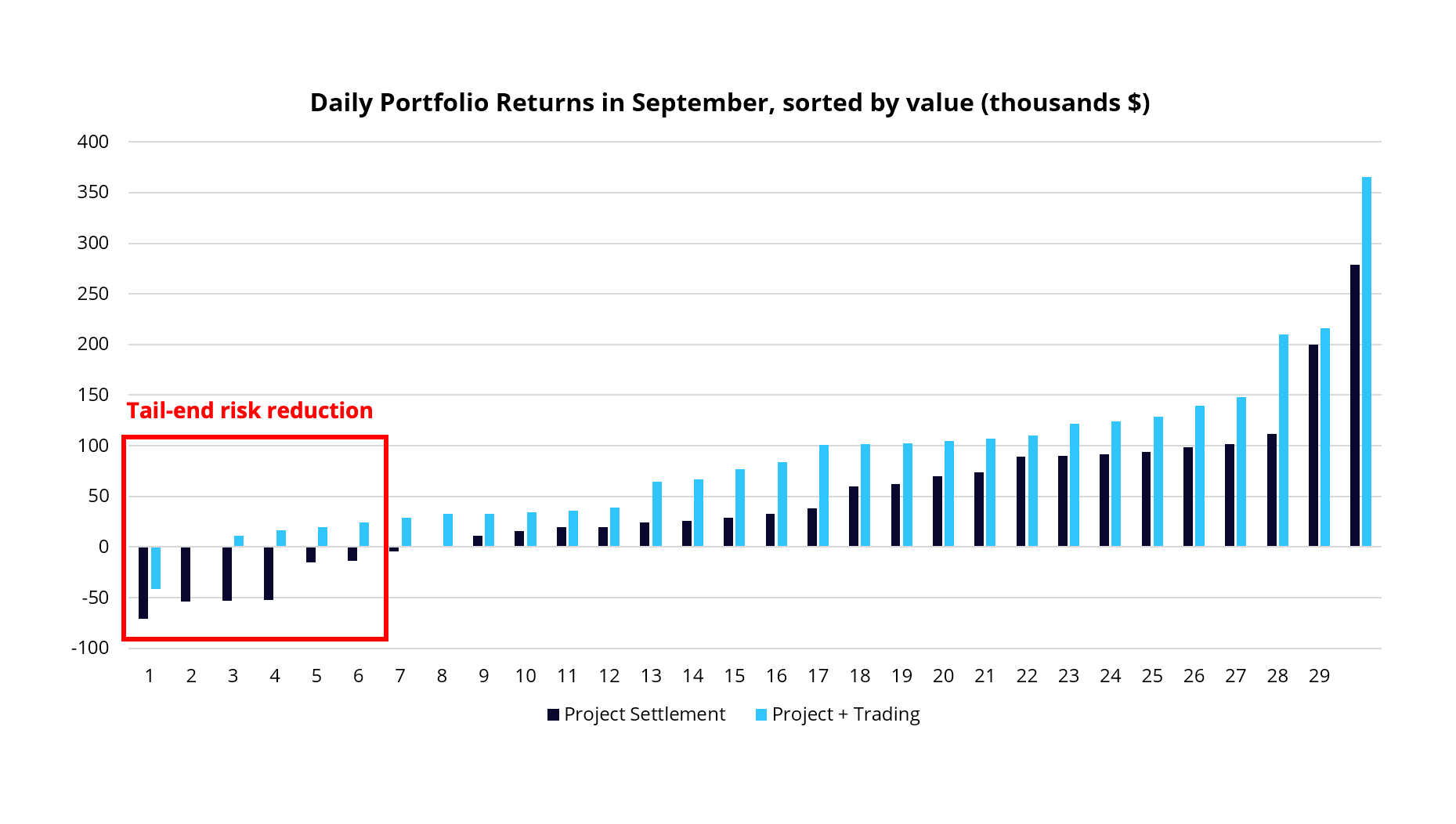

Unlike prop trading, when conducting trades around an asset, the trades themselves often pose risk in the form of “opportunity cost” (i.e. you could have made more money by not trading). While it is indeed true that by trading around an asset you can still incur losses, introducing asset-backed trades within an agreed upon risk framework can serve to add value when the project would otherwise lose money, thereby limiting the tail-risk posed to project revenues.

The Trade-Off

When the project is performing well and offtake risk is minimal, the value-add of asset-backed trading will be lower. When substantial risk is present and performance at the project level is poor, asset-backed trading will provide more value and serve to better stabilize revenues.

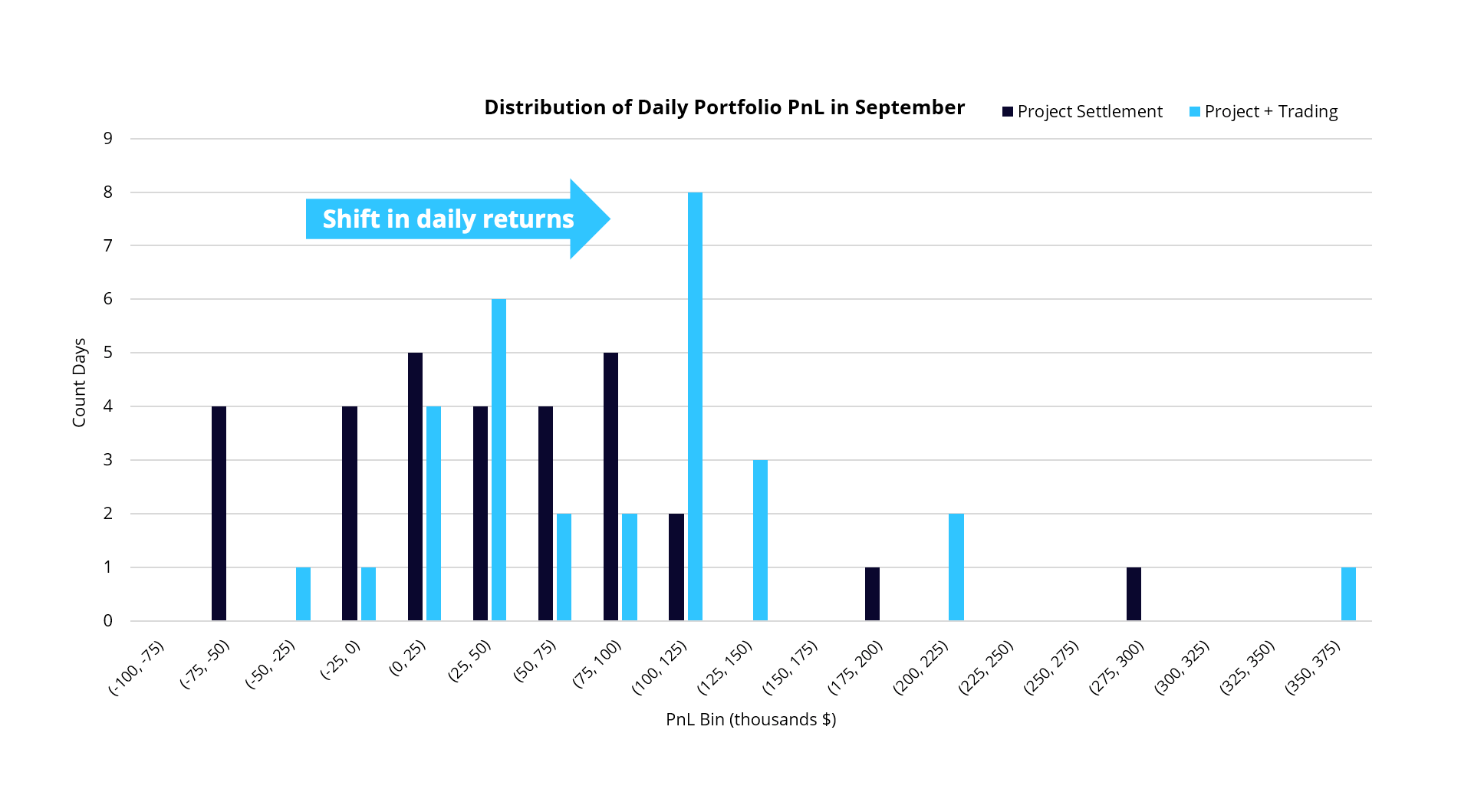

Statistically, when comparing a distribution of returns with and without asset-backed trading, the results with asset backed trading should demonstrate two important trends.

Firstly, the return profile should be shifted outwards (reflecting in an increase in PnL) that ultimately results in an increase in the average PnL relative to a passive strategy.

Secondly, the return profile corresponding to asset-backed trading should show a reduction in leftward tail-risk (i.e. periods during which PnL was excessively negative for brief periods in time).

In short, the Active Asset Management strategies deployed by CWP Energy Solutions are focused around mitigating risk, and as a result add incremental revenues that serve to limit earnings volatility.

How does asset-backed trading protect PTCs?

Tax equity economics are a large driver of negative pricing in ISOs across North America.

With wind resources having a marginal cost of $0/MWh, most asset owners are willing to sell their power at marginal cost ($0/MWh) less PTC value, making the offer equal to “negative PTC.”

But what happens when the tax equity value of a newer project is greater than that of an existing project? During periods of high wind generation, low load, and heavy congestion, the marginal price of electricity supply is set by a generator with a lower offer price, and it is no longer economic for your asset to run. In short, you are curtailed, and no longer generating PTCs.

Enter asset-backed trading. If a hedge in the Day Ahead market or term congestion market can be established such that the effective sales price of the generator is greater than negative PTC, the generator can run-through periods during which it would otherwise be curtailed.

Project owners and tax equity sponsors alike are quickly learning that “doing nothing” is not riskless. The surge of renewable projects following a sustained backlog and the injection of capital from the IRA poses increasing risk to new and existing projects alike. The acceptance and understanding of asset-backed trading is essential to project longevity and the stabilization of earnings over the long term for every stakeholder in any renewable project.