Return to "normal"?

Stability in natural gas market remains at odds with change in power market

August 2, 2023 | CWP Energy Solutions

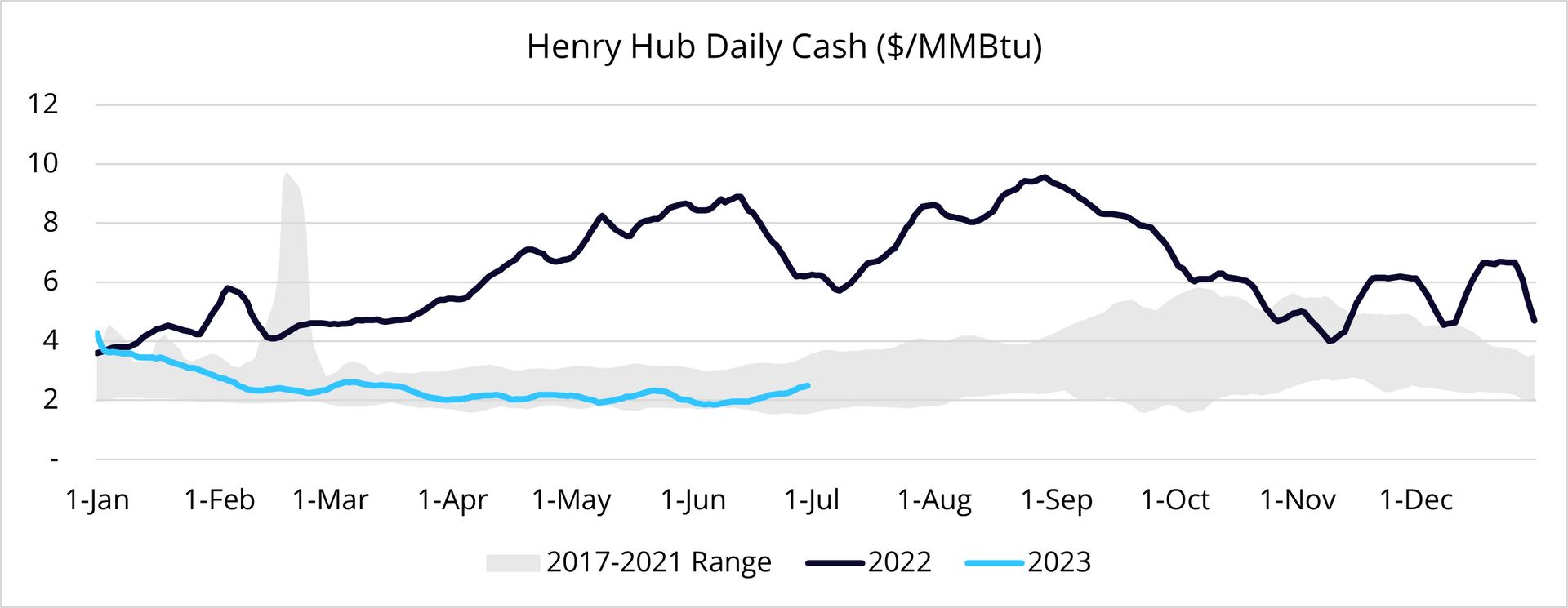

The days of $10/MMBtu Henry Hub now seem like a distant memory.

At this same time last year, natural gas and power markets alike were struggling to assess the upside potential to natural gas prices, with storage deficits and international conflict pointing to ongoing tightness in the global natural gas market. The onset of an exceptionally warm winter was sufficient in restoring natural gas storage near multi-year highs, driving cash and forward pricing back down near $2/MMBtu in the US. The whiplash in natural gas pricing has brought about changes across North American Electricity markets in 2023: some familiar, others, a new paradigm.

Note: Values above shown as a seven-day moving average

Coal-fired generation continues to lose market share

While natural gas prices skyrocketed in 2022, so too did global coal prices, driving increased export demand for US thermal coal and US coal prices accordingly. While intuitively one might conclude that a rapid ascent in natural gas pricing would make coal-fired generation more cost-competitive, the opposite was in fact true. Looking at gas-fired generation as a percentage of total fossil-fired generation across the US lower 48, gas-fired generation gained near 10% market share from Jan 2022 to Nov 2022. Following a mild winter, gas-fired generation constituted over 70% of total fossil-fired generation, and has presided at such levels since Feb 2023. The reduction in coal-fired market share has also made increasingly clear that the outright reduction in coal-fired generating capacity continues to weigh on its ability to serve as a substitute for natural gas.

Additionally, despite the influx of renewables coming online, natural gas has managed to constitute about 40% of total supply year-to-date. It is worth noting that this is due in part to well below-normal wind speeds when compared to above-normal wind speeds seen in 1H 2022.

Note: Values above shown as a seven-day moving average. Source: EIA

In the context of power markets, the prevalence of natural gas-fired generation lends to less volatility, with more dispatchable generation available to meet demand (all else equal). The relative increase in natural-gas fired generation also drives incremental natural gas demand, creating support for natural gas pricing accordingly. Lower commitment of coal-fired generation as seen in 2023 lends to less divergence between day-ahead and real-time pricing, with day-ahead pricing often reflecting the incremental commitment cost of coal-fired resources that then become price-takers in real-time. The increased dispatch of coal seen across 2022 also led to higher forced outage rates and real-time price volatility accordingly.

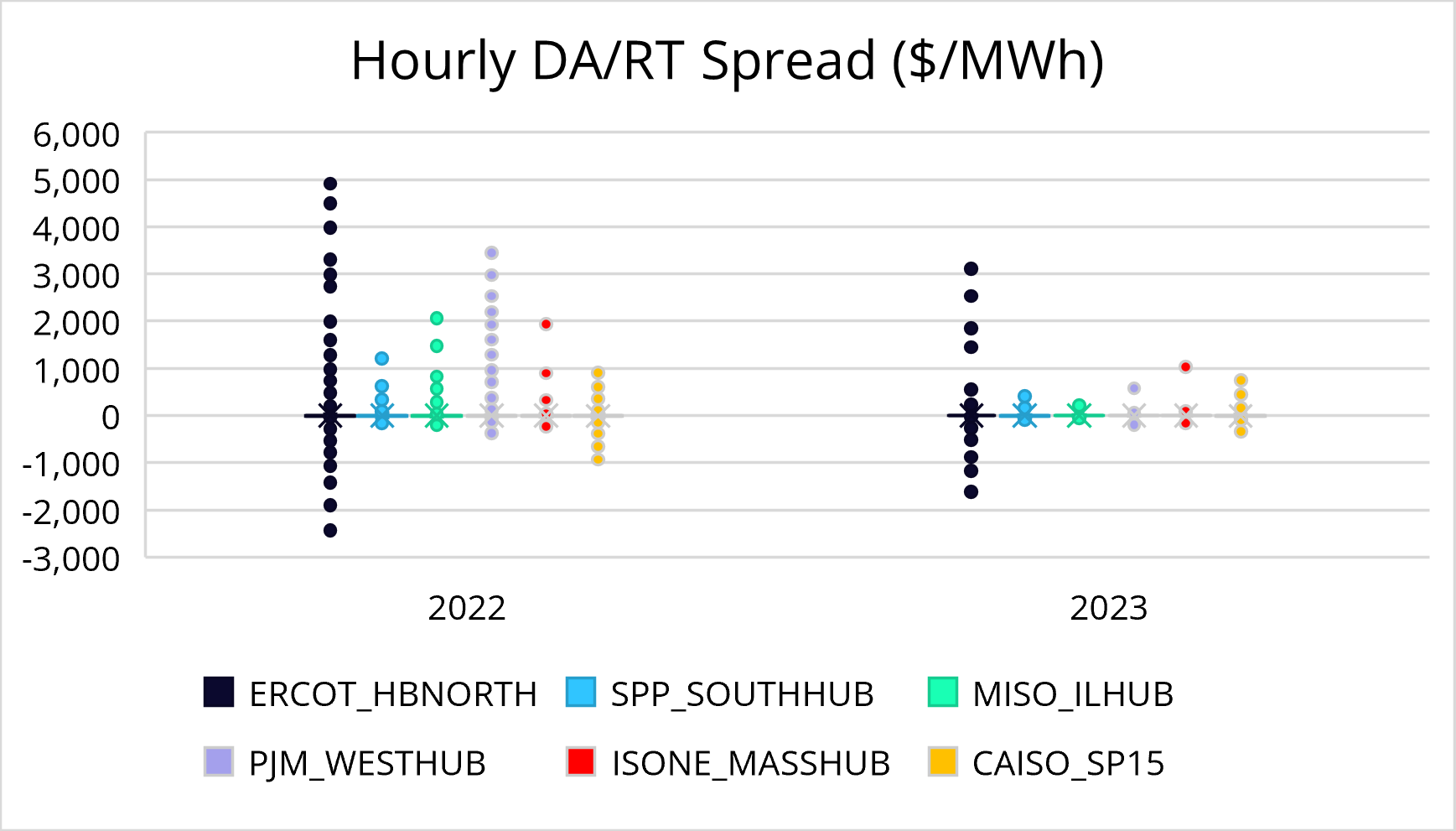

Power price volatility dives

As natural gas prices have declined moving into 2023, so too have power prices, falling off substantially from multi-year highs seen last year. The general decline in pricing has also diminished volatility, as the price impact of committing gas-fired peaking plants to cover a load miss or miss in renewable generation is directly proportional to the decline in natural gas pricing. The resulting increase in elasticity, or “flattening” of the supply curve, has not only led to reduction in outright price volatility, but also a narrowing of DA/RT spreads, offering less opportunity in optimization value.

Note: Box-and-whisker on the top includes outliers; box-and-whisker on the bottom removes outliers for the sake of better visualizing distribution of data

One exception to the aforementioned trends has been CAISO, where ongoing tightness has garnered substantial price volatility in the late evening peak. While outliers have been limited in quantity (likely an artifact of a limited sample size in the year-on-year comparison), the distribution of DA/RT spreads has been very similar when compared to 2023. In addition to seeing more renewables in the stack, CAISO natural gas pricing has remained volatile and relatively elevated.

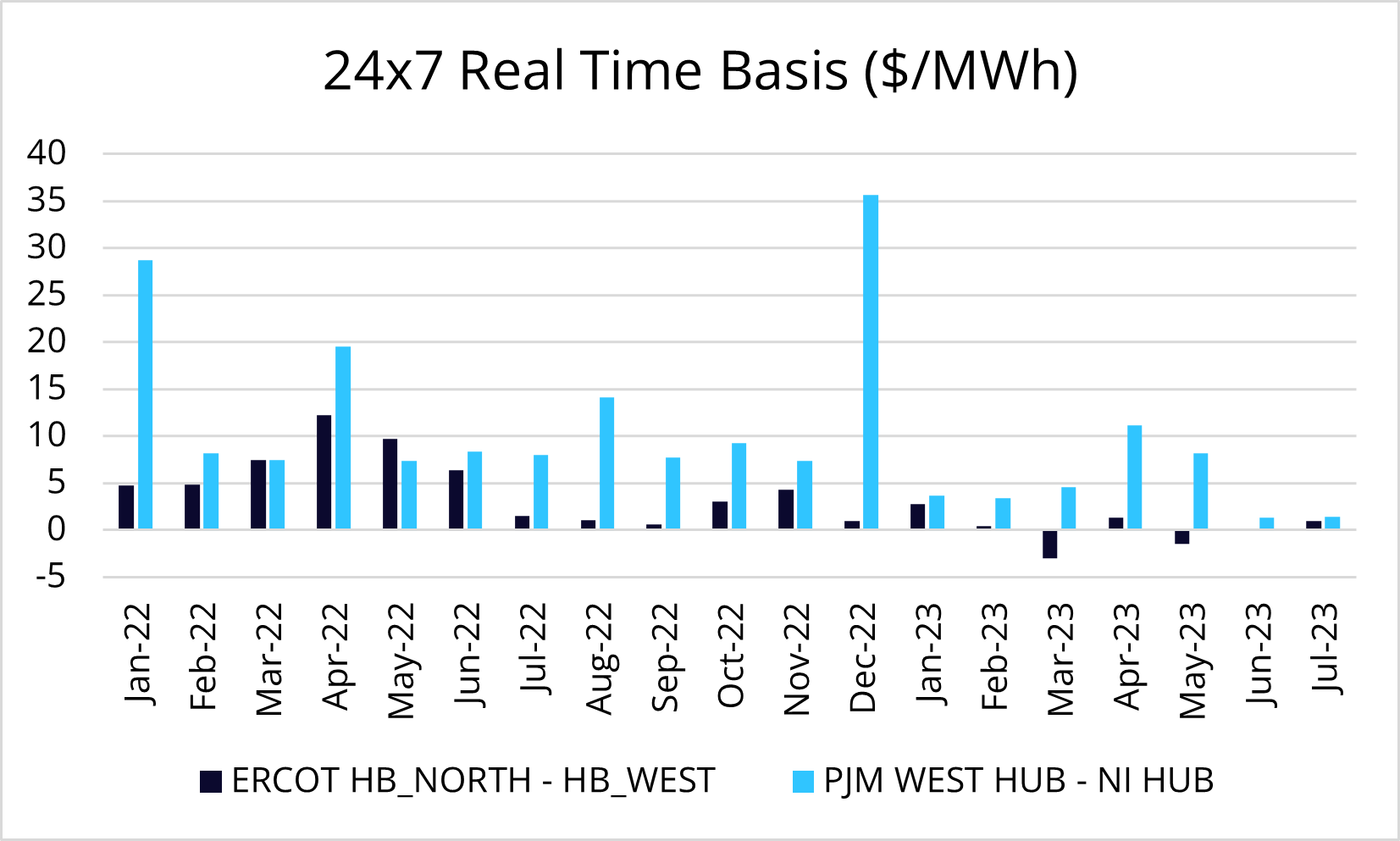

Basis? What basis?

The severe nodal price dislocation seen across many ISOs last year has subsided alongside price volatility, allowing many asset owners some long overdue respite from harrowing double-digit basis. The congestion, priced heavily into forward congestion markets in 2022, has subsided significantly. The decline in natural gas prices has undoubtedly played a role in setting hub settlement prices lower. However, in ERCOT, for example, growing demand from data centers and Bitcoin mining facilities has offered a different source of congestion relief, with loads sited in closer proximity to heavily congested regions.

While at a macro level the decline in the pricing environment lends to lower basis, fundamental shifts in market dynamics (additions of load, renewables and battery storage, as well as retirement of fossil) continue to drive localized congestion that poses significant risk to individual assets.

Sell high, buy low

While the opportunity to sell into “peak fear” has certainly passed, we are rapidly approaching levels at which fundamental floors exist: not only to pricing, but also to congestion. With wind at weaker-than-normal levels through the first half of 2023, we have seen congestion clear in auction at levels asset owners could only dream of throughout 2022. While there is little to suggest a bull run in gas like we saw in late 2021 and into 2022, power burns and the subsequent operation of LNG export facilities in the coming year(s) offer a sustained source of demand for natural gas, providing price support accordingly.

On the power side, ongoing load growth coupled with the retirement of fossil-fired generation and influx of renewables and storage poses increased risk of price dislocation stemming from oversaturation of renewables. Recent issuance of IRS guidance on the Inflation Reduction Act, in addition to the approval of FERC Order 2023 (which targets backlogged interconnection queues), is likely to prompt another wave of renewable resource builds.

Though it may not be keeping asset owners up at night right now, basis and price dislocation are continued concerns, and the general lack of congestion poses an opportunity to get a plan in place to be proactive in managing asset risks. Portfolio risk management does not happen overnight – risk policy development, power market education, and data integration are all integral to managing risk before a single trade is made.

Don’t fall into the trap of thinking your portfolio is sufficiently de-risked just because of a change in market conditions. If you’re interested in being well-positioned for the grid of the future, be sure to contact us to see how we can help get the necessary tools in place to be ready for the next wave of power market dynamics!