The Storage Bubble

A Widening Bid-Ask for Battery Storage Projects in Development

April 7, 2023 | CWP Energy Solutions

Since the inception of prolific renewable build-out, storage has been a cornerstone of the Energy Transition: a means by which to make intermittent, volatile wind and solar energy sources more predictable and serve demand when it is needed most.

In theory the concept is simple. The asset consumes energy from the grid or a co-located resource when wholesale power prices are low, and discharges, selling the energy, when prices are high. The more storage installed, the more renewables built, the more fossil-fired generation displaced.

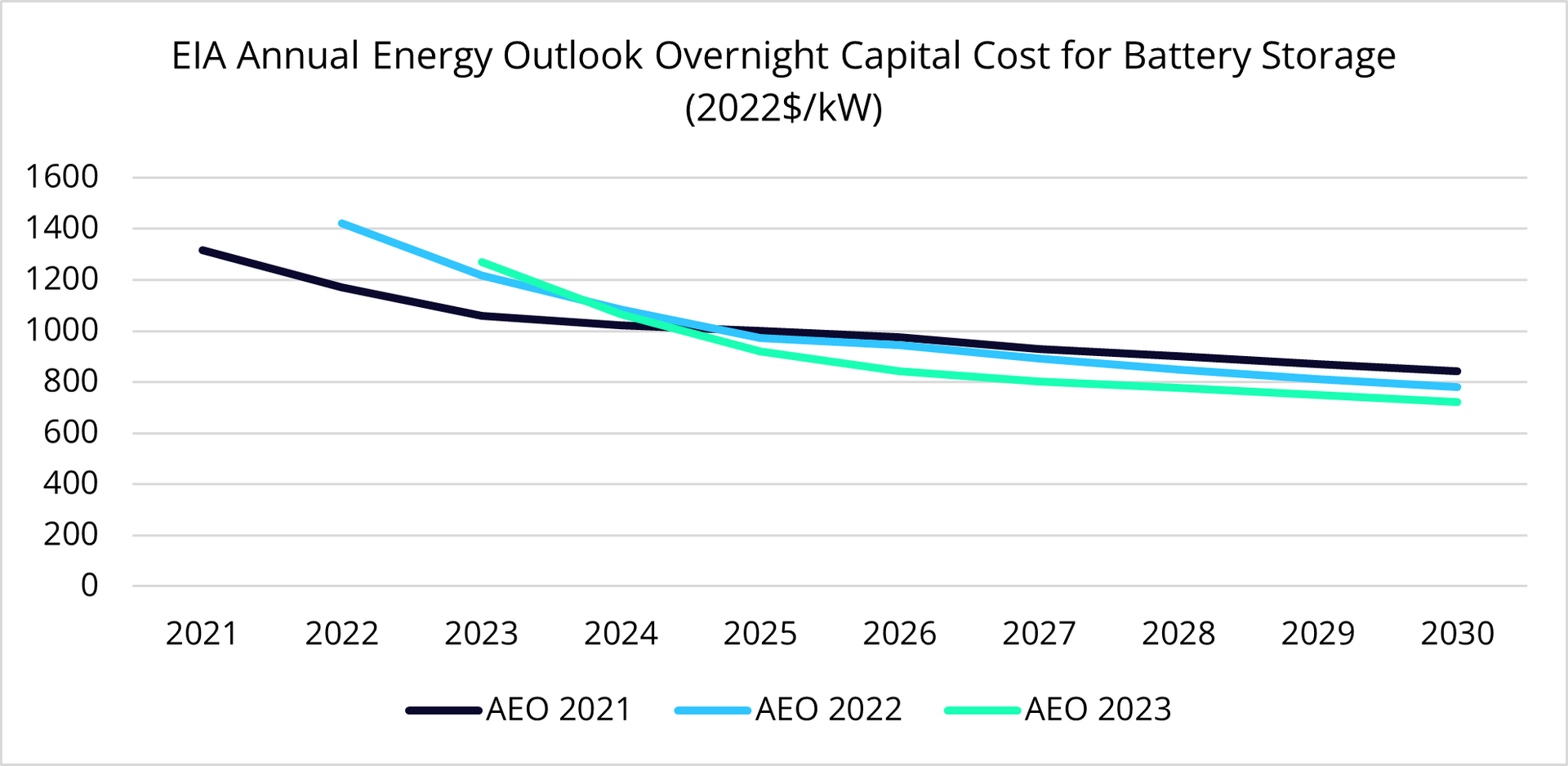

As battery storage progressed from a concept to a reality, developers uncovered more practical challenges. While battery storage costs have decreased, they are still expensive resources with a future cash flow that is difficult to value, leading to what will become the most popular question among the development community in 2023: What is the best way to finance battery storage?

The answer to that question lies within the initial challenge of valuing the future cash flow. While it would be ideal for a utility to provide a twenty-year revenue stream based on the utility’s perspective on how it benefits the ratepayers (who will ultimately pay for the asset regardless of its actual value), merchant storage operators cannot afford the luxury of being incorrect on a storage valuation.

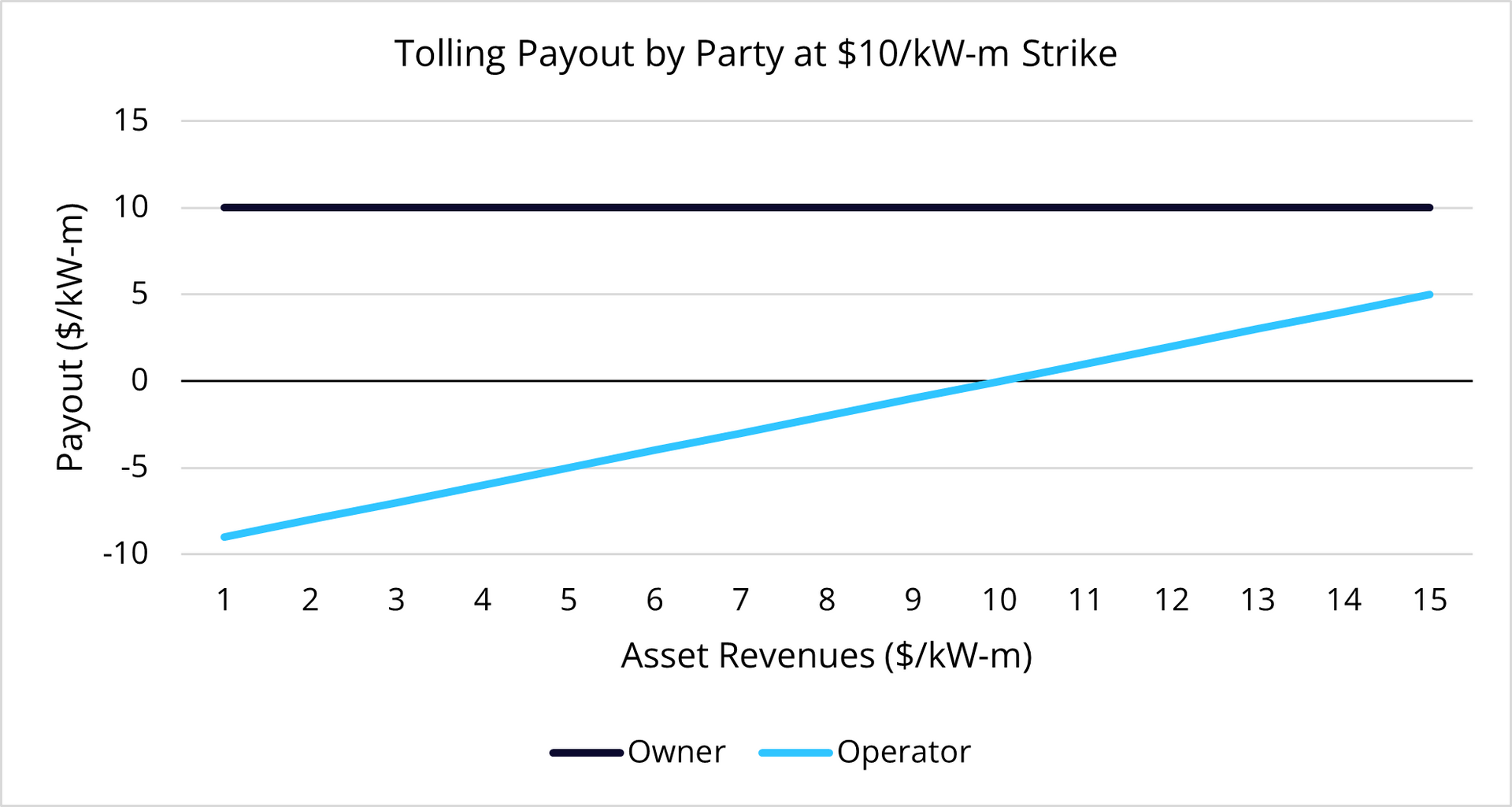

To-date, many stand-alone battery storage projects being transacted-upon are financed on the back of various types of tolling agreements. Under these agreements, the operator of the storage asset pays the developer and/or asset owner an agreed-upon fixed price to have access to the merchant revenues. This largely boils down to the valuation of the asset, lending to a very asymmetrical relationship between counterparties.

Naturally, the developer will set the asking price around the cost of developing the asset and a desired margin, which has often led to asking prices ranging from $10-15/kW-month. The bid will be set around where the operator believes they can comfortably make margin – in unregulated markets the highest bids we have seen of recent have been in the upper single-digits. A waning gas price environment (lending to lower volatility in electricity prices) and the expectation for an influx of supply for ancillary services – whether from other storage assets or controllable loads – has weighed on the expected value for future cash flow accordingly.

Storage is still being built – just with less haste. Much of the standalone battery storage hitting commercial operation in 2022-2023 is getting built by integrated developers/operators who have the balance sheet and appetite for merchant risk. Unsurprisingly, the increased risk appetite is often accompanied by expertise in energy trading, a testament to what is required in running a successful battery storage operation. Still, a general lack of diversity in battery storage duration (typically 2-4 hours) lends to fear of revenue cannibalization – where competing storage assets diminish returns by capturing the same revenues.

With future cash flows uncertain and tolling agreements difficult to get to the finish line, we have seen the emergence of more creative structures. Some examples include a forward sale of the highest-priced four hours of the day, or a forward sale of the energy arbitrage value between the lowest-priced two hours and highest-priced two hours of the day (commonly referred to as “top-bottoms”). Others have written out-of-the-money call options, securing financing using the premium collected up-front. In contrast to increasing the complexity, some have simplified the tolling agreement altogether, offering a revenue put on the asset in order to help get it financed.

Simple or sophisticated, extracting the most value from a storage asset requires an advanced understanding of both power markets and optimization. Limitations on state-of-charge, daily charging cycles, and resource parameters limit the ability for human operators alone to dispatch storage in an optimal fashion. Likewise, “industry-leading” optimization engines and scheduling platforms are diminished by a lack of foresight into power markets or inability for operator oversight.

At CWP Energy Solutions, our storage offering combines the technological sophistication required in optimizing storage with our market-leading analytics and trading expertise, taking a proactive approach to maximizing storage value. As battery storage projects fall short of valuations and asset owners seek more merchant exposure, the models and tools used to value future revenue streams will be put to daily use and challenged in an operational setting. We expect those with experience in power market trading to prevail, leaning on a tested approach to risk management to unlock the earning potential for storage assets.