Summer 2023: What we’re watching

July 17th, 2023 | CWP Energy Solutions

As temperatures continue to rise, we are eyeing a multitude of emerging market dynamics affecting North American Power Markets. In this blog, we’ll discuss markets we’re watching closely as we move into the peak summer months.

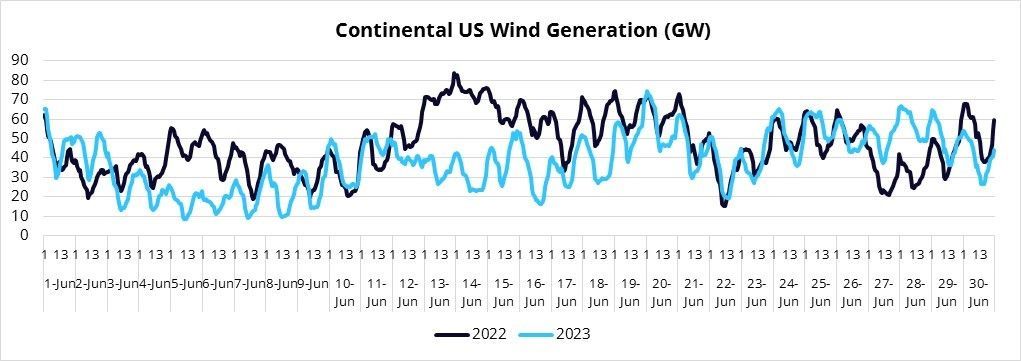

The Winds of Change

After several years, La Niña is officially over, and El Niño is officially upon us. The change in weather patterns has already been stark, with a cooler, wet start to the southern half of the continental US and a rather dry and warm start to the Midwest and northern half of the Midcontinent. June saw a rapid decline in wind speeds across the country, with US Wind Generation averaging 38 GW, compared to 47 GW a year ago – down nearly 20%! Relative to the 30-year mean, wind speeds across the Midcontinent were as much as 2 m/s lower in June, which in some cases equates to nearly 50% below normal. Forecasts suggest windier conditions moving into July, which will provide more wind generation, assisting ISOs in meeting this summer’s elevated peak loads.

Source: EIA

Midwest Tightness Failing to Materialize

It is no secret – MISO has slim reserve margins – and the anomalous heat expected throughout the region certainly provides little relief for a market that has little room to spare. MISO’s 2023 Summer Assessment called for a probable peak load in June of 115 GW, though summer-to-date MISO has been largely spared, with peak RTO demand only getting up to around 108 GW. The CPC continues to show above-normal temperatures through July in MISO South especially, though for the time being, reserve margins appear in-tact. The increased heat in the South certainly poses risks of higher pricing in the region, but we anticipate reserve margins to remain healthy barring system-wide heat.

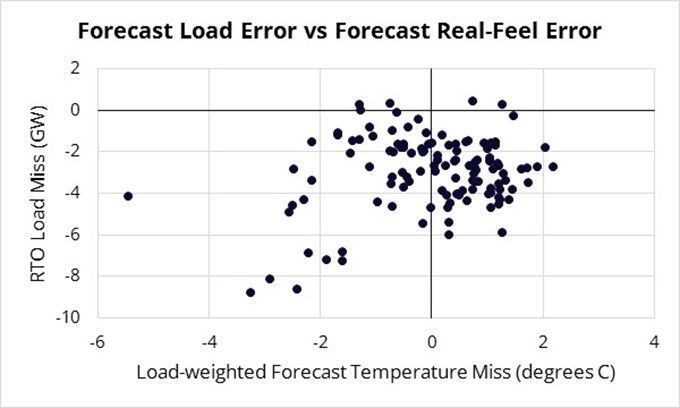

ERCOT Peak Shaving in Full Effect

The growing number of flexible loads within ERCOT has drawn attention to the magnitude of load response in Texas, aiding the RTO in limiting real-time price spikes throughout the summer to-date. Indeed, a closer look at temperature data suggests unexpected storms played a large role in sparing ERCOT on a handful of days in June, though the load response on days where temperature forecast deviation was negligible suggests a formidable quantity of curtailable load. As is evident in the chart below, on days when temperatures came in very close to forecast, load was frequently 4-5 GW under the day-ahead forecast. Additionally, even when temperatures came in above forecast, loads were 2-4 GW under day-ahead forecast.

Note: The above chart shows ERCOT RTO Load vs Load-weighted Temperatures, with “miss” referring to actual less day-ahead forecast. Data has been filtered to show forecast RTO load in excess of 75 GW in hour-ending 12 through 20.

With heat lingering in the forecast across the country, we continue to monitor North American Electricity markets for opportunity and risks, ensuring our Clients are best positioned to take advantage of summer conditions. As we have become increasingly accustom to, fiscal results can be made or lost in a handful of hours each year, and this year is no different.

Don’t get lulled to sleep by warm summer days! If you’re looking to extract incremental value from your portfolio or protect your assets from the increased risks during summer, be sure to contact CWP Energy Solutions to learn how our insight and strategy can help you achieve your goals.