The rise of clean power-by-the-hour:

Is “sustainability”, sustainable…?

August 28, 2023 | CWP Energy Solutions

As ESG mandates and scrutiny of publicly-traded companies continue to rise, the demand for clean power purchases has also increased. Shareholders have begun to demand more of clean power purchases – with renewable energy credits or carbon offsets from a distant land no longer sufficient to fulfill or “check the box” for “green” energy consumption.

Clean power-by-the-hour structures

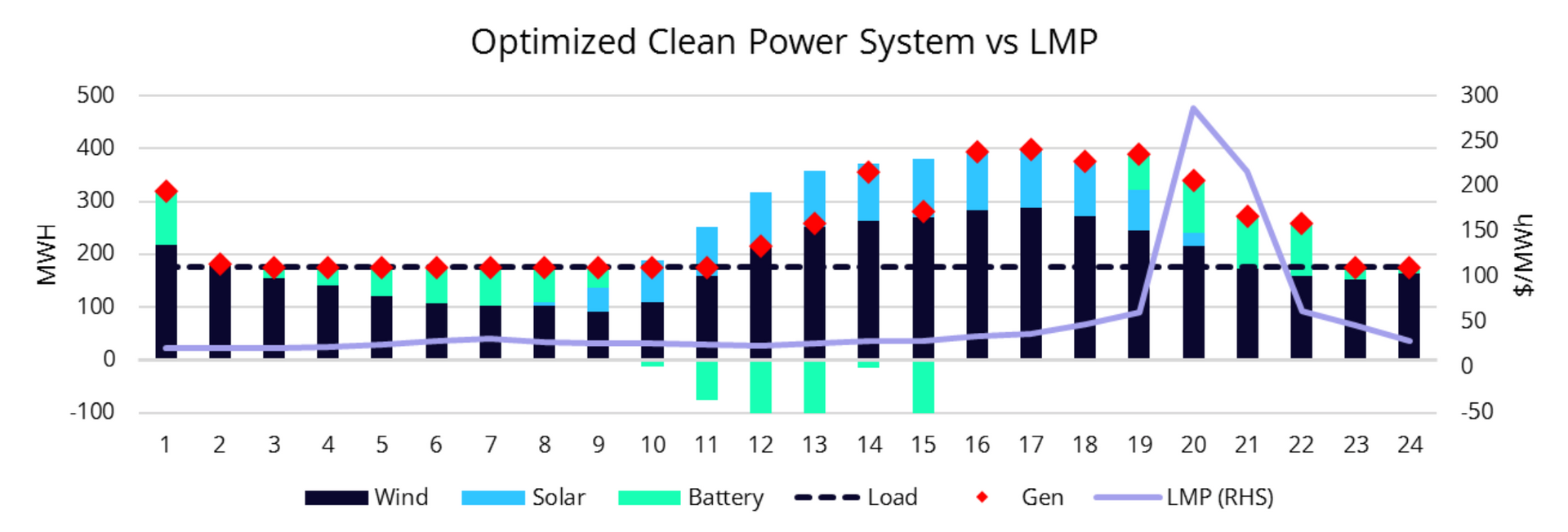

As clean power procurement evolves, markets have begun to adapt to suit the needs of offtakers who need to demonstrate their power consumption is met with the purchases of clean power. We continue to see high capital investment in wind, solar and battery storage to fulfil these 24x7 requirements, with intermittency backfilled by nuclear and hydro-backed physical power flows. Financial markets have begun to adapt to serve 24x7 needs as well, with bundled power and REC on- and off-peak structures growing in popularity.

Note: The above image shows a hypothetic wind/solar/storage facility used to power a 175 MW load. Battery storage dispatch is optimized to maximize excess power sales while meeting the needs of the load, subject to operating constraints.

24x7 power is accompanied by 24x7 risk

Of course, clean power-by-the-hour demands an incremental premium, and the risks associated with that form of offtake are higher and more difficult to quantify.

Though the risk itself are not new, the time element to clean power-by-the-hour contracts heightens the risk inherent to offtake contracts relative to traditional PPAs. Volumetric risk with a “clean component” is an obvious concern, while basis (and curtailment) risk poses challenges to the generator and offtaker alike. The future grid also poses increased spot price risk, with the ever-growing inverse relationship between renewable generation and wholesale power prices. Stated otherwise, if your 24x7 offtake is not fulfilled in a stated timeframe, it’s likely it is unfulfilled for others as well, driving up the spot price for energy and RECs in that timeframe accordingly.

Approach Carbon Neutrality risks around-the-clock

The ability to actually manage the risk within 24x7 clean power contracts has been largely untested. The evolution in contract structuring will inevitably play a roll in better allocating risk, as we have seen in Virtual PPA structuring. For example, the treatment and management of curtailment hours poses risk to both the buyer and seller, and creative structures allocating that risk between parties allows both buyer and seller to be insulated from the downside.

However, (despite what your legal department might tell you), not all risk can be “contracted-away.” This is especially true for 24x7 clean power contracts. Trading and risk management practices – both within a physical portfolio (co-location optimization) and within a financial portfolio (including hedges) – will be paramount to stabilizing revenues within 24x7 contract structures. Creative financial products providing hourly liquidity will also play a role in aiding “backfill” volumetric or spot price risk when physical resources are unavailable. Indeed, we have already seen the emergence of these products made available by storage assets and controllable loads looking to sell premium in exchange for cash flow to aid in financing.

In order to move the market forward, corporates, LEUs, and project developers must either build internal trading expertise or find new partners to ensure their carbon neutrality investments do not become burdened by risk subject to market volatility.

Let’s talk about how our current partnerships are working to solve these problems and help companies move the needle with their investors while protecting their returns.