Volatility in Congestion

Are you prepared for 2023?

November 21, 2022 | CWP Energy Solutions

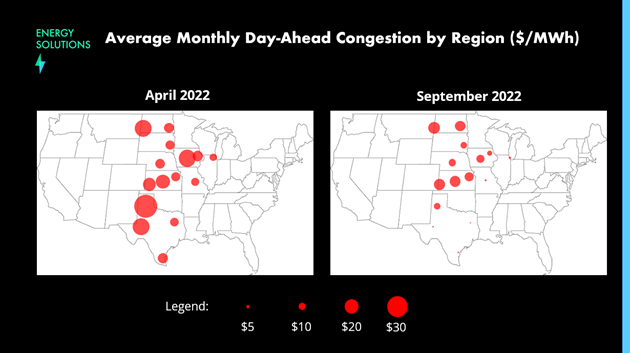

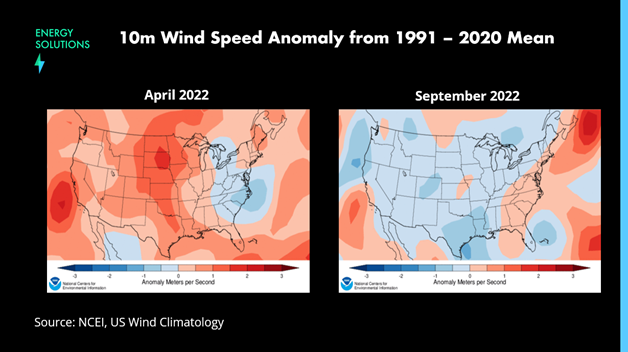

Congestion throughout 2022 has fluctuated vastly throughout the year, particularly in regions with substantial concentrations of wind. As one may suspect, 2022 demonstrated tight correlations between wind speed anomaly and some of the most congested regions in North America.

April 2022 was one of the windiest months in recent history, particularly in the Mid-Continent. An analysis of congestion throughout the Eastern Interconnect and ERCOT reveals the top fifteen congested regions all fell within the Mid-Continent.

Those same regions in September, however, saw a notable drop in congestion as wind speeds came in well below the twenty-year trailing average, illuminating the extreme volatility that renewable assets can face in just a matter of months. The same projects that suffered from paralyzing basis risk and curtailment in April saw a dramatic reduction in volumes in September, resulting in lower offtake revenues and in some cases, incremental volumetric risk, as production volumes were unable to cover hedge volumes. In addition to the increase in volumetric risk, general lack of production volumes also incite scrutiny from tax equity and reduce REC volumes available for offtakers to meet sustainability goals.

The contrast between months also highlighted the ineffectiveness of passive strategies. The same FTR hedges for basis that were incredibly lucrative in April were large losers in September, as the weakness in wind coupled with strength in gas prices going into outage season often led to system-wide price strength.

While wind speeds themselves will remain subject to randomness, the ongoing build out of wind generation in areas with sustained wind speeds is much more certain. We expect the Mid-Continent in particular to see a continued influx of wind capacity as delays in new build subside and the market digests and capitalizes on the Inflation Reduction Act. As a result, the severity in volatility will only increase.

As asset-backed trading is slowly being embraced and long-term basis hedging remains elusive and costly, having a full toolbox at your disposal becomes paramount to efficiently deploying capital. We’re interested in fostering partnerships with those looking to stabilize project revenues.

As we move into the beginning of 2023, reach out to CWP Energy Solutions to see how we can support your team in mitigating risks posed by volatility to your portfolio.