Basis: Is it gone and forgotten?

September 12, 2023 | Chris O’Donnell

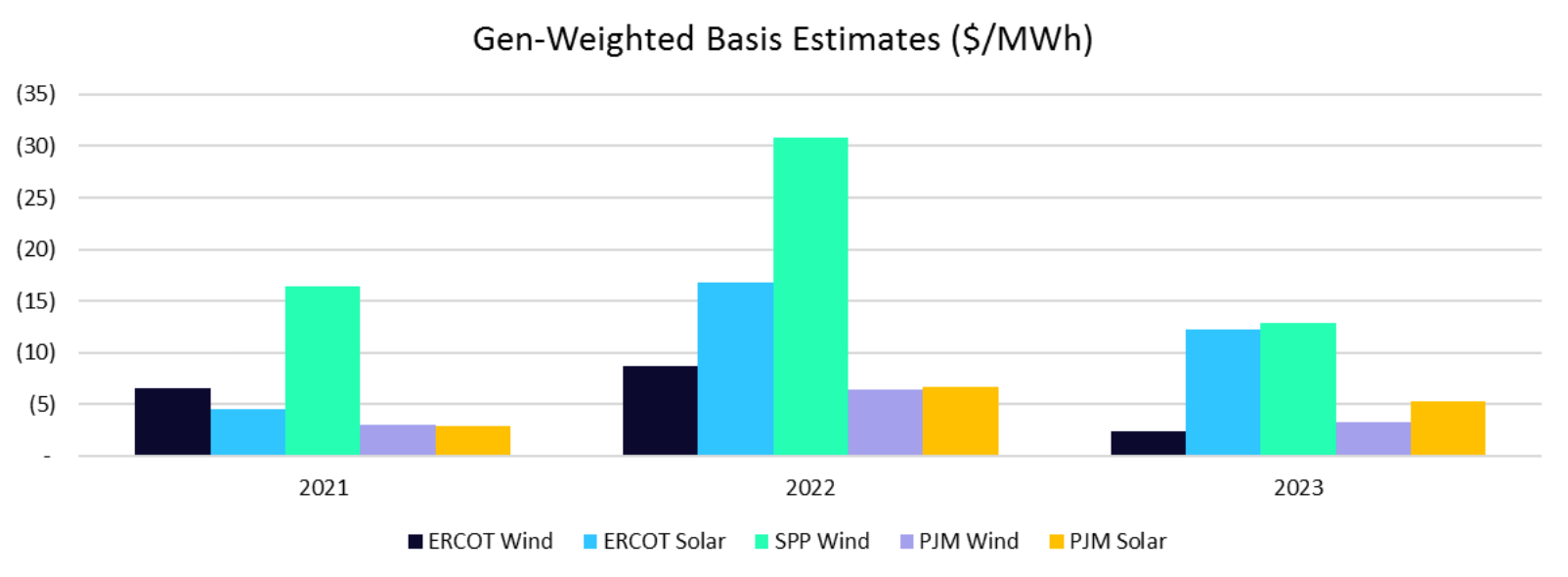

Since 2021, basis has resulted in significant losses across many ISOs. For a sample 100 MW renewable project, the range of bottom line implications has varied from half a million to near $13 million annually.

Many renewable generators with hub-settled PPA offtake saw basis expand so significantly that the fixed-for-floating payout at the settlement hub to the offtaker exceeded the resource revenue at the node. The resulting losses challenged project valuations and kept many owners sleepless with limited ability to do anything about it.

As we alluded to in our

August blog post on the return to a low gas price environment, heavily congested regions seen throughout 2022 have seen congestion subside significantly in 2023.

| Basis Cost ($) | ERCOT Wind | ERCOT Solar | SPP Wind | PJM Wind | PJM Solar |

|---|---|---|---|---|---|

| 2021 | $2,520,000 | $980,000 | $6,570,000 | $912,000 | $595,000 |

| 2022 | $2,450,000 | $3,940,000 | $12,760,000 | $2,173,000 | $1,360,000 |

| 2023 YTD | $450,000 | $1,490,000 | $3,380,000 | $640,000 | $791,000 |

However, the nightmare that was 2022 for many has largely been forgotten, with basis subsiding to more palatable levels across North America. Though the collapse in natural gas pricing has played a large role, lower wind speeds and supply-chain driven delays to renewable build has aided in keeping basis at bay.

As we look into the future, gas prices are merely one source of concern. What’s going to happen when the delayed projects come online? What will existing resources in congested regions do when their PTCs expire? How will existing resources coming to the end of their current PPA compete with new build?

Will project companies take advantage of the “cheap” opportunity to hedge basis for the “next 2022”?

Note: Figures shown assume the following as-generated PPA structures:

| Scenario | Resource Location | Settlement Location |

|---|---|---|

| ERCOT Wind | HB_WEST (RT) | HB_NORTH (RT) |

| ERCOT Solar | HB_SOUTH (RT) | HB_HOUSTON (RT) |

| SPP Wind | SECI_SECI (RT) | SPPSOUTH_HUB (RT) |

| PJM Wind | PJM NI Wind Nodes Sample (RT) | N ILLINOIS HUB (DA) |

| PJM Solar | PJM SOUTHIMP (RT) | DOMINION HUB (DA) |

As shown in the chart above, basis expanded significantly for wind in 2022, though levels YTD have moderated significantly. While gen-weighted basis for wind has come down closer to 2021 levels, the same cannot be said for solar, which (while still lower) has only moderated slightly. Additionally, the growing solar saturation in the areas of focus (South TX and Southern PJM) lends to further basis expansion regardless of which way gas moves.

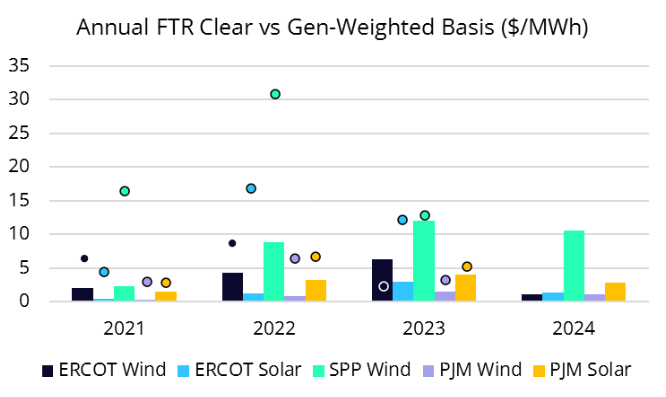

Basis – while ever present – does not have to be unmanageable. Looking back at annual FTR clears prior to 2022, there was no shortage of good entry points in which one could have hedged basis at very manageable levels.

Note: Bar chart reflects Annual FTR clears for respective market, asset, while points plotted reflect realized gen-weighted basis.

With that in mind, a “blind” strategy of procuring FTRs at every opportunity would have made money in 2022 but lost money in 2023. In some ways this serves as a benefit in stabilizing project revenue, but more importantly bidding strategy and market timing can offer substantial optimization opportunity.

Looking into 2024 and beyond, FTRs are now trading closer to levels seen for 2022, begging the question: is now a good time to hedge my basis?

The answer is yes, but as history tells us, how you hedge your asset is critical to hedge effectiveness. Clawing back even 25% of the ERCOT W-N basis seen across 2021 and 2022 would have yielded $1.25 million for a 100 MW asset, while the benefits of getting ahead of basis in SPP would have yielded tremendous returns.

Proactive risk management will be the headline for 2024, as many renewable project owners build out their own internal capabilities. As the first solar projects eligible for PTC energize, can you afford to continue to leave your project cash flows subject to market volatility? How much can you afford to curtail if ERCOT solar additions push mid-day pricing negative in the coming years?

A proactive approach to risk management is the only manner by which renewable project owners can stabilize project revenues with confidence on an ever-changing grid. Let’s talk about your portfolio and check off the first step in shifting to a proactive risk management approach.