Word on the Street:

Takeaways from GCPA

October 9, 2023 CWP Energy Solutions

Last week CWP Energy Solutions was in Austin, TX at the Annual Gulf Coast Power Association Fall Conference (GCPA), where we were able to talk power markets, risk management and more with market participants across North America. Below are a handful of common themes that emerged across our conversation.

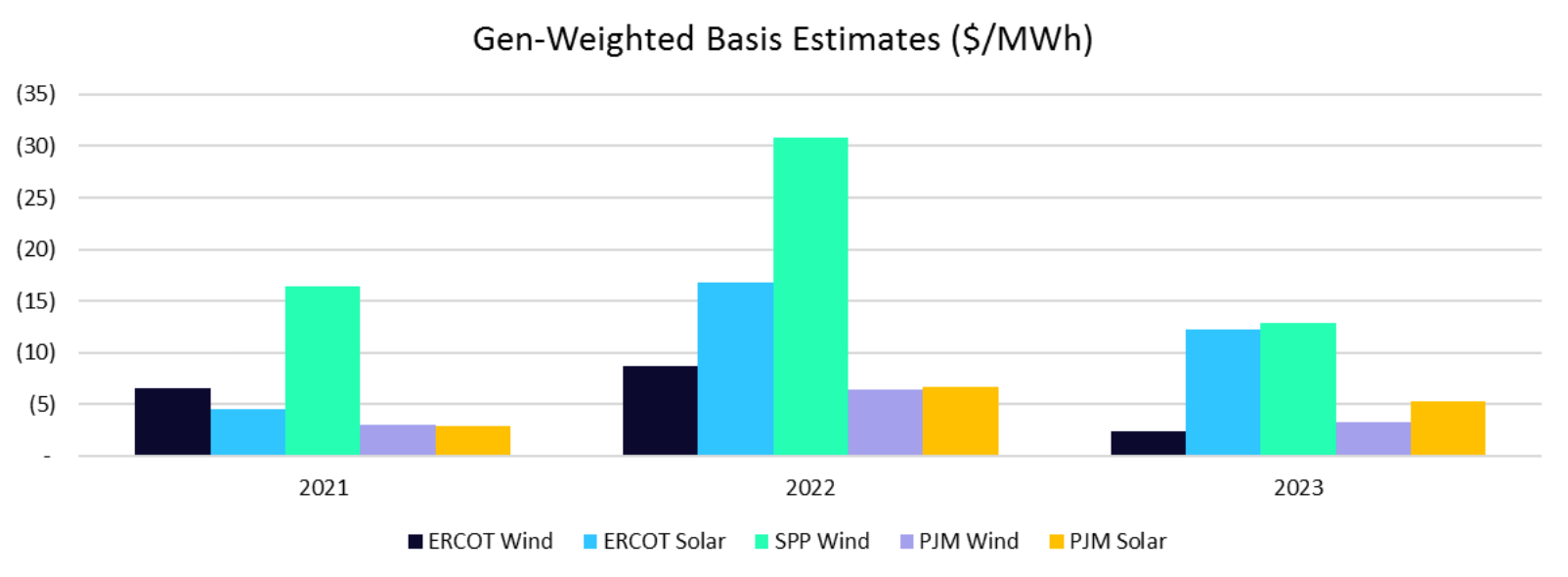

Basis risk remains a concern, despite the drop in congestion

As we have frequently discussed throughout the year, the decline in gas prices relative to 2022 has driven congestion across the country lower, lending to less detrimental basis for renewable resources. The decline in realized congestion has driven congestion forwards lower as well, providing more attractive hedging levels for resources facing prospective basis risk in the future. Resource owners continue to seek efficient ways to manage the risk associated with basis.

M&A activity remains rampant, with foreign investment funds and infrastructure funds on a spending spree

The turnover of projects remains elevated, with foreign investment funds and infrastructure funds bidding on both existing and in-development renewable projects across the country. We have seen a heavy pick-up in M&A-support activity as well, with buyers and sellers looking to quantify attractive bid and offer levels, while simultaneously assessing risk and prospective earning opportunity. Developers are more frequently tasked with comparing own-and-operate models to divestiture, while simultaneously evaluating future rounds of development, which are implicated by the onset of proceeds from the IRA in addition to increased risk from market changes and evolving market fundamentals.

Battery storage optimization continues to prove challenging

While operating assets in ERCOT benefitted from August volatility, the jury is still out for meeting valuation expectations in the shoulder periods. CAISO in particular remains a challenged area for storage performance relative to initial valuation expectations, though actual financial results are likely equal-parts over-valuation and operational inefficiency. We anticipate this trend to continue to emerge in ERCOT, as ancillary services further erode in value with incremental battery storage capacity additions in the coming months/years.

A rapidly-evolving fundamental landscape continues to pose challenges to storage valuation. While we have seen tolling bids erode substantially over the past year, it remains to be seen if the battery storage tolling market remains over-valued. Indeed, the increase in liquidity for hourly options and T2B2 structures seems to suggest that may be the case. We look for more sophisticated trading parties to take advantage of their competencies in evaluating these complex structures at more palatable levels, as developers continue to widen their financing options.

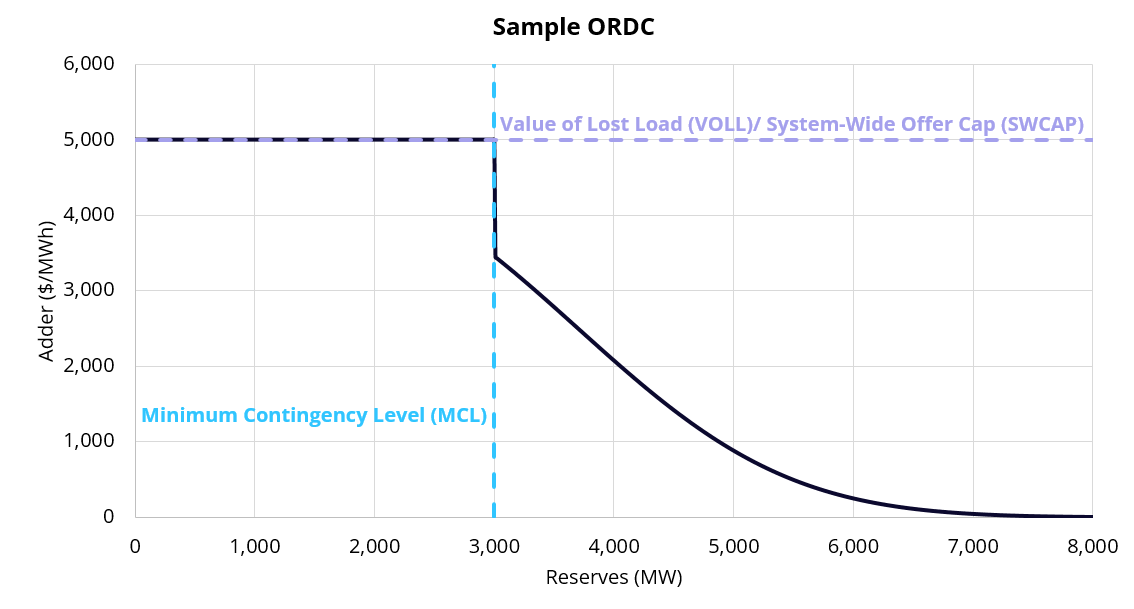

Market still trying to make sense of impending ERCOT changes

Market rule changes were a frequent theme across panels and conversations alike at GCPA, with the implementation of DRRS, the change to ORDC structure, and the prospect of PCM prompting various discussions around implications across ERCOT markets. While there remains a lot of ambiguity, people were generally confident that one way or the other ERCOT will see more gas-fired generation, which weighs on future price volatility and A/S value accordingly. We continue to track developments in ERCOT and what is seemingly a growing disconnect between the current state of peak reserve tightness and future oversupply.